A Harvest of Distress

Farmers are on the brink and the tragedy of Sangrur tells us why

/wp-content/uploads/2017/06/Distressharvest1.jpg)

THE FATE OF farmers and ground-water levels in Sangrur district of Punjab have complemented each other quite well—touching new depths of uncertainty in the last few years. While the former has gotten increasingly entangled in the debt- cycle, the latter have retreated at an alarming rate, with rice cultivators boring deeper and deeper in search of water.

The reality of farmer distress in Sangrur challenges the folklore of Punjab’s agrarian prosperity. Those who care for data, 2,213 farmers have committed suicide in Sangrur over the past two decades. Kishangarh village in Malerkotla tehsil of this district recorded a shocking number of 79 such suicide cases till 2015. Kulrian, with 31, and Bahadurpur with 20 cases appear next on the list and are less than 10 km apart from each other. Most cases are of landless farmers who work on rented land, and the suicide rate is extremely high among small and marginal farmers, compared to those who have larger land holdings. Even though the numbers are so large, denial of the distress persists due to lack of clarity in state-recognised procedures to identify, collect and publish data on such deaths. “Suicide cases were suppressed. Even today, the government does not admit to the suicides. We started taking note of them in 1988,” says Inderjit Singh Jaijee, who has been supporting the affected families and has played a significant role in Sangrur by devising a mechanism of panchayat-level certification of farmer suicides as distinct from others. An affidavit from the village panchayat also states whether debt—irrespective of its source—was the cause.

Sangrur’s figures reveal an outstanding loan amount of Rs 2-2.5 lakh per household, a staggering average. Most of the suicides occur between May and October. A high rate of suicide in this period can be linked to a bad harvest of Kharif crops and increase in debt burdens due to low market prices. The pressure to repay mounts rapidly in such a scenario, followed by the inability to get further credit for future farming operations, therefore increasing stress levels. Failure to execute sowing operations for the next season as a result of a dip in creditworthiness leads to extreme distress in those months.

Suicide is an ultimate response to a series of intense factors, and given the interdependency of these, it would be unfair to identify a single factor as a primary cause and overlook the others. A comprehensive understanding of this matter requires a holistic grasp of how several factors contribute to raising stress levels.

Exorbitant Land Rents

The transformation of Punjab’s agricultural sector within a span of a few decades—the 60s to the 90s—from subsistence farming to a modern, mechanised and commercial one that produces more than two crops a year is well acclaimed. However, farming practices that include cash rentals for land, labour costs, tractors, deep tube wells, fuel, seeds, animal feed, harvesters, combines, repair, chemical fertilisers, insecticides and weedicides have increased the cost of production manifold. The National Sample Survey’s 70th Round, under its ‘Key Indicators of Situation of Agricultural Households in India’, shows that the total monthly expense per agricultural household in Punjab (Rs 11,768) is way above the national average of Rs 2,192. In all other categories of expenditure such as on seeds, fertilisers, chemicals, repair and maintenance of machinery, and labour, Punjab features far higher than all other Indian states.

Sangrur has the highest percentage of land lease rates (per acre) compared to other districts of the state. The annual land lease rate has gone up to as high as Rs 50,000 per acre in 2016, which has raised the cost of cultivation significantly. The input cost for paddy is close to Rs 25,000 per acre for one season. Even though rice is one of the few crops that enjoy a Minimum Support Price, the fluctuation in actual prices has nullified the advantages of such state assurances. A farmer is barely able to cover costs, let alone make sufficient profit to run a household. Hence, he constantly questions the instability of prices or demands an enhancement of his loan amount from formal credit sources or expects more sensible crop insurance mechanisms that are more localised and take into account village-level variations that cause him damage.

Commenting on the cost escalation, says an arthi, a commission agent who also mediates between farmers and the market: “Expenditures have increased manifold. They have to spray pesticides two-three times a season. Spraying pesticide on one acre of land costs around Rs 1,500 to Rs 2,000. The cost of a DAP packet was Rs 470 three to four years ago. Now it costs Rs 1,200. A urea packet was priced at around Rs 150. Now it costs Rs 300. Three years earlier, farmers used to pay only Rs 50 a day for a labour, but now they have to pay more than Rs 300.” High land lease rates in Punjab have encouraged many land-owning farmers to rent out their farms fully or partially to generate income without the burden of carrying out farming operations. It also suits those who have quit (or intend to) farming for other income pursuits but want returns from their land.

Rice is Wrong

Different agro-climatic zones have different crops suitable to their eco-systems. Cultivation that goes against prescribed patterns of sustainable practices tends to have a disastrous impact. Falling water tables threaten farmers across the state and particularly those who operate on smaller land holdings with less resources. With the water table going down each passing year, a farmer invariably has to bear the huge recurring cost of digging deeper without any assurance that the new depth at which water is available today would be available in the future. To a large extent, the jump in farming costs can be attributed to irrigation expenses on paddy.

Rice cultivation is not harmonious with the agro-climatic conditions of Punjab, as pointed out by a local bank manager. “Paddy requires huge amounts of water. Only a very small proportion of the cultivable land is under canal irrigation in Punjab. The bulk of it is dependent on ground water. A farmer with two acres of land has to spend the same amount on boring a tube-well as compared to a farmer who has large land holdings.”

Conversations with older farmers confirm how the unprecedented shift in cropping patterns—especially the dominance of paddy—has spread within the span of a generation. “When we were young, paddy was sown in less than 2 per cent of the cultivable land,” says one, “Now, everyone is cultivating paddy. Earlier farmers used to cultivate, bajra, sugarcane, jowar and other fodder as well.”

In Debt to Arthis

A bank charges an annual 4 per cent interest on a loan up to Rs 3 lakh. An arthi, in contrast, charges 22-24 per cent per annum. Most farmers have to borrow money from these agents, as bank loans are insufficient. Given the limitations of the formal credit system, this dependence on arthi credit is no surprise. Since the prices of agricultural produce have failed to keep up with rising input costs, even as Punjab’s—and Sangrur’s in particular—land rents are highest in the country, farm incomes have proven inadequate to sustain households. Routine household consumption, basic health and educational costs have all risen sharply, while cash flows from farms for families have been squeezed. Small and marginal farmers bear the brunt of it, since their income-cost gap is the widest.

Punjab also ranks very high as a consumer of durables such as mobile phones, cycles, TVs, refrigerators, washing machine, air conditioners and vehicles. Here, an arthi plays a dual role of selling the output in the market and satisfying a farmers’ need for liquidity whenever required. The rate of interest may vary from a monthly 2- 3 per cent, depending on the loan amount, urgency and farmer’s creditworthiness and rapport with the lender. Unlike the typical moneylender, an arthi can be of support in ways that ensure a farmer would not like to spoil his relationship with him. The arthi, on the other hand, being assured of a crop share, already has a guaranteed return mechanism in place and hence need not take recourse to violent measures to recover his capital investments. The debt can always be settled against the harvest.

Checks and balances in the relationship between a farmer and an arthi operate in the following manner, as explained by one himself: “By offering credit, an arthi makes farmers his customers. After receiving credit, a farmer is obliged to return the money and also to sell his crop to the same arthi, who will get a 3 per cent rate of interest per month from the farmer and also a 3 per cent commission on selling the crop. An arthi cannot sell the land, but the farmer will not be in a position to sell his land either. In any case, if a farmer wants to sell his land, then he has to sell it to the arthi from whom he has borrowed.”

Family members of those who committed suicide acknowledge their indebtedness to arthis. Not a single family where one or more members had committed suicide was free of debt from non-institutional sources, and the bulk of the money was owed to arthis. Farmers in Sangrur, particularly those working on smaller land holdings and those using rented land, are excessively dependent on arthis for short-term crop loans and even household expenditure. Farmers lack storage facilities and this also compels them to sell their crops to arthis soon after the harvest, even if they do not get the best price; the high interest burden intensifies the pressure to liquidate stocks.

Keeping Up

A large chunk of the loan money is not merely diverted towards essential non-farm household expenditure but also to purchase markers of affluence in an assertion of class identity and display of aspiration. Much of this money is spent on grand ceremonial ventures, particularly weddings and for buying status symbols such as cars and machinery. Irrespective of their land holdings, farmers go out of their way to borrow money to ‘keep up’ with others. Observes Professor HS Shergill, who has worked extensively on the agrarian crisis in Punjab: “Someone with just 3 acres of land is also sending their children to Australia for higher studies. Earlier, there was no expenditure on LPG, electronic gadgets, mobile phones, etcetera; family members usually spent time together. Now each member has his own lifestyle; hence they spend individually as well. Every farmer has his own vehicle, even though he finds it hard to buy one. If a farmer takes money for agricultural reasons and then uses that amount for other expenditure, then certainly he will not be able to repay.”

Given the increase in input costs and the relatively non-remunerative aspect of agriculture, it is obvious that farming cannot generate enough income to support heightened consumerist desires. Spending propensities going beyond farmers’ actual means are reflected in the following words of another arthi: “Farmers also spend a lot of money on marriages. There is a kind of competition between villages on wedding expenditure. Those who have the capacity to spend only Rs 5 to 7 lakh, even they end up spending Rs 25 lakh. Only 10 per cent of farmers have the capacity to spend so much. The rest try to emulate the 10 per cent and that leads to a trend of spending more than what they can, and then they get trapped in debt. The division of families has also increased expenditure. Now almost every family has a tractor, whereas one tractor can serve four families. They take loans and they think that they will sell one portion of their land to repay. That leads to a complete sellout… Dowry is also a big reason for farmer indebtedness. The farmer who owns one or two acres of land demands a car in dowry.”

The Shame of Debt

It would be flawed to assume that suicide is a problem in itself. Rather, it is a manifestation of a series of problems that are mostly man-made. It will be equally erroneous to presume that suicide brings relief to the suffering family. Rather, the ability to repay diminishes after a suicide in any family. Neither does it yield a solution nor does the outstanding debt get a waiver.

The problem worsens after a farmer takes his life, as the family is often left without an earning member and the debt burden is heavier. “We were compelled to sell off the land to repay loans. Earlier we had 4 acres each between the three brothers. Now, we are left with less than half an acre each,” says the wife of a deceased farmer, identifying debt as the cause of her husband’s suicide. Incidentally, three brothers from the same family committed suicide in Andana village. Each of them owed Rs 4-5 lakh. The wives were not aware of the loan figure while the husbands were alive. This is typical. The bereaved usually hear of it once moneylenders come for recovery. As opposed to popular presumptions and representations in movies like Peepli Live, they do not always turn up for recovery right after the suicide, as they fear being accused of the death; even if they do come, they do not mount pressure.

However, a loss of dignity brought about by the inability to repay often leads to severe distress—more so if the farmer is indebted to relatives, neighbours or friends with whom he has ties that go beyond the impersonal and transactional. The fear of public ridicule is acute.

To Whomever It May Concern

Agriculture accounts for merely 13 per cent of India’s GDP now, while in 1947, its contribution was around 50 per cent. Yet, it continues to support nearly half the country’s total workforce. Clearly, the decrease in agriculture’s share of GDP has not been accompanied by a matching reduction in its share of overall employment. Demographically, it continues to be the broadest economic sector, which makes it a matter of great concern if it continues to be non-remunerative and disaster-prone, pushing small and marginal farmers into new corners of grief.

Without incentivising cultivation better suited to the country’s various agro-climatic zones, promoting crop diversification to help rejuvenate soil fertility, and encouraging alternative sources of income, the future of Punjab’s farmers looks bleak. Sangrur is not an isolated example of where and how we have gone wrong and have not made course corrections. In the past fortnight, we have witnessed violent manifestations of the anxiety and unrest in the farm sector. A further delay in implementing vast reformative measures to modify cropping patterns, restructure institutional credit disbursal systems, and create alternative non-farm sources of livelihood might result in irreversible damage. Farm turmoil and suicide rates have served us a warning.

(This article draws on a research project commissioned by the RBI, conducted by the university and whose report was co-authored by Professor Ajay Dandekar and Dr Sreedeep Bhattacharya. The views expressed here are solely those of the author)

About The Author

CURRENT ISSUE

MOst Popular

3

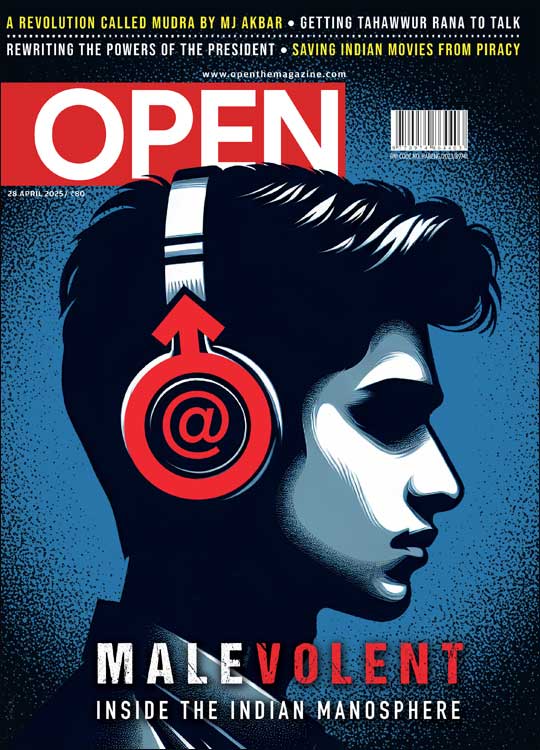

/wp-content/uploads/2025/04/Cover-Manosphere.jpg)

More Columns

‘Colonialism Is a Kind of Theft,’ says Abdulrazak Gurnah Nandini Nair

Bill Aitken (1934 – 2025): Man of the Mountains Nandini Nair

The Pink Office Saumyaa Vohra