In Cold Blood

WE HAVE ALL heard of highly inventive products that crashed and burned in the marketplace: the Tata Nano is one such. So is the Segway, the electronic two-wheeler scooter that was supposed to revolutionise transportation, until it didn't. Today we have a number of supposedly earth-shaking products that may or may not share their dire fates— crypto-currencies (looking weak these days), even blockchain (despite the hype), CRISPR-Cas9 (designer babies supposedly delivered in China raise significant ethical issues), hyperloop (travel at high speed in a pod in a vacuum?), even Apple's failed PDA, the Newton.

Innovation theory suggests that a firm can pursue innovation in three ways—as a need-seeker, a market-reader, or a technology leader. In the first mode, the firm is intuitive— it tries to identify the kinds of things that people need, or don't even know they need, but will just love it if they can get their hands on it (think 'microwave oven'). It is a risky approach, but if you hit the right spot, the payoff can be tremendous.

In the second, the firm is marketing-focused. It may survey customers, see what its peers are doing, fast forward in linear fashion for a couple of years, and anticipate and build the functionality that will be required—basically, keeping up with the Joneses.

The third mode demands R&D and is engineering-driven. The firm strives to invent something that is bleeding-edge technology, and to use that to drive new product development. There are significant costs associated with this approach, especially as 'solutions in search of a problem' are a sure way of wasting money (examples include the Picturephone, a massive failure for AT&T when it first introduced it—nobody apparently wanted to see their caller in those days, unlike today when Whatsapp video calls reign supreme).

Imran Khan: Pakistan’s Prisoner

27 Feb 2026 - Vol 04 | Issue 60

The descent and despair of Imran Khan

Furthermore, when your idea is disruptive (Clayton Christensen of Harvard Business School coined the ubiquitous term 'disruptive innovation') and attempts to change the status quo in the industry, there are powerful forces arrayed against you. The incumbents in the industry are not going to just stand around watching while this new company comes and threatens to just upend your cosy little ecosystem—consider how electric car company Tesla has had to fend off the older car companies even though its product is markedly superior. Inertia is a big factor.

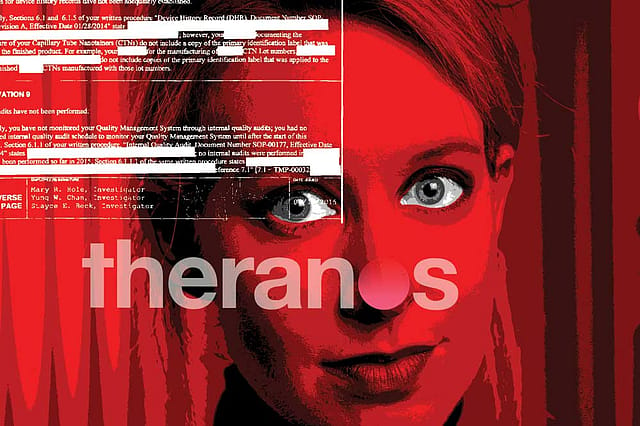

Thus, when Theranos first appeared on the scene in 2003, promising to revolutionise the blood-testing process and make it less painful and less expensive, it was evident that the big players in the medical device market, such as Siemens, GE Medical, etcetera, or big blood-testing firms, such as Quest and LabCorp, were not going to sit back and watch their market share disappear. Many of us cheered for the plucky little upstart trying to slay Big Medicine, notorious for its voracious appetite for consumers' money.

Theranos had a seductive vision. Instead of the painful drawing of venous blood from the elbow area with a big needle that most of us endure under duress, Theranos' patented technology could be used to just prick your finger, draw 2-3 drops of blood and use that to run a whole battery of tests and send results wirelessly to you and your doctor. An appealing idea indeed.

Add to that a charming CEO, someone straight out of central casting—young and beautiful, a dropout from Stanford, intense and charismatic, one who apparently carries a 'reality distortion field' with her so that anyone who encounters her is instantly bewitched into believing her vision. A bit like Steve Jobs of Apple, did you say? Yes, and she did indeed model herself after him, down to the trademark black turtleneck and the intensity.

Silicon Valley is full of stories of driven young CEOs who overturn entire industries, and incidentally make themselves and their investors oodles of money—think Google, Apple, Facebook, Tesla. But few of them are women, and to a country obsessed with gender issues, the personable Elizabeth Holmes was a godsend.

Holmes soon became the toast of the town. She also managed to gather around her an unmatched board of directors—George Shultz and Henry Kissinger, former US secretaries of state; William Perry, former US secretary of defense; James Mattis, current US secretary of defense; Channing Robertson, Stanford Engineering professor; Don Lucas, ace venture capitalist; David Boies, ace lawyer who made his name in the antitrust suit against Microsoft; Rupert Murdoch, media baron; former US Senators Sam Nunn and Bill Frist, who was also a doctor. Most startups would die to have these people on board, and Elizabeth Holmes convinced them all of the Theranos vision.

Holmes also managed to convince most of the media and even hard-bitten investors about the possibilities—she raised over $700 million, including some $100 million from Rupert Murdoch alone. She also brought in distribution partners such as the Walgreens pharmacy chain and the Safeway grocery store chain, which spent large amounts in kitting out their stores with spaces where Theranos' machines would quickly give test results to consumers—no need to wait in a hospital for your blood work.

It was indeed a compelling argument: who wouldn't want to avoid those big needles (the stuff of childhood nightmares)? Holmes herself said that a childhood phobia of needles had set her on the path to easy blood tests with just a pinprick on a finger and a few drops extracted. To get there, Theranos had to create a whole lot of new technological solutions, convince the consumer market about efficacy, and find ways of reaching consumers easily.

In general, Silicon Valley firms need to worry about creating new technology, finding a way of bringing it into the hands of consumers, who would then presumably fall in love with the stuff. In my experience, most startups are all about item 1 (technology), but have no idea about item 2 (distributing the product) and item 3 (creating value for the consumer). And there's also that rather critical item 4 (raising funds).

Theranos was pretty much the opposite—it had customer value, knew how to reach them through pharmacies and grocery stores, and was able to raise oodles of venture capital. At one point, it was valued at $9 billion. But the tragedy is that it didn't quite have the technology. Furthermore, Holmes then started being economical with the truth—the hype machine had gone so far ahead of reality, there was no way she could pull back without a major loss of face. And in the Valley, that is fatal.

IN THE END, technology failed Theranos. It required several leaps in the state of the art that even its obsessive, driven startup culture couldn't quite manage. Even though the company came out with several generations of blood-testing machines (namely, the Edison and MiniLab), it was simply not able to get the miniature blood vials (nanocontainers) right, and the small volume of blood from the pinpricks was not sufficient to get good test results comparable to traditional methods (they ended up having to dilute the blood).

This sort of thing is not unheard of in Silicon Valley because early prototypes often don't work out, or there are externalities (for instance, a key specialised component from a partner is not available in time). The answer is to go back to the drawing board and try to figure out a work-around.

But there is a difference in Theranos' case—the usual Valley products are software and electronic gizmos, which work in an unregulated industry, and often do relatively little harm to consumers even if they fail. Blood-testing, on the other hand, is in the domain of the powerful Food and Drug Administration (FDA) and is strictly regulated; wrong diagnoses, inappropriate remedies and other forms of harm could mean massive potential (class-action) lawsuits.

For a long time, there were rumours that all was not well with the company, but that was chalked up to competitors putting about FUD (fear, uncertainty and doubt), standard Valley practice used by incumbents against insurgents (IBM and Microsoft were said to be champions at this black art). Nevertheless, most media coverage was positive.

Until, that is, a reporter at the Wall Street Journal named John Carreyrou started investigating the story, based on a tip-off. When he dug deeper and began to interview former employees, doctors who had used the services, and patients who had stories of misdiagnosis, he realised that there was something that didn't quite meet the eye. His story was a staggering exposé, and he has documented his three-year battle with Theranos in a bestseller, Bad Blood: Secrets and Lies in a Silicon Valley Startup. It has won some prestigious awards, including the FT/McKinsey Business Book of 2018.

Carreyrou paints a picture of a company that is paranoid (but that is per se not unusual when creating new intellectual property), has a dominant leader who is by turns charming and tyrannical (but that is exactly how Holmes' idol Steve Jobs was), and is willing to lie, exaggerate and mislead (but that has been done by many tech companies). A certain amount of stretching the truth is acceptable, but it appears Theranos stepped over a fine line and consciously started building an edifice of lies.

After it discovered that its tiny nanocontainers could not quite give consistent results, and its early Edison machines proved problematic, Theranos ended up secretly installing commercially-available Siemens machines in its labs, and pretending its results they produced were in fact from its Edison machines. Unfortunately, the tiny amounts of blood the Theranos process extracted had to be diluted to create the volume needed by the Siemens machines, and that produced erroneous results.

Thus, in a far cry from Theranos' original promise of small portable machines in blood-testing centres in grocery stores and pharmacies, it had to now ship the samples to its centralised testing facilities. And in many cases, it had to use Siemens machines for the tests (with the diluted samples). Furthermore, the company found that it had to draw blood the old- fashioned way, with needles, in an increasing number of cases.

THE EDIFICE OF lies grew daily, and it finally became what appears to be outright fraud. An early investor sued, alleging it had been deceived with 'a series of lies, material misstatements, and omissions'. Both Holmes and Ramesh Balwani were blamed. Ramesh 'Sunny' Balwani had been second-in-command, as well as Elizabeth Holmes' live-in boyfriend. He was much older, and had made a fortune in an earlier Silicon Valley venture he started. Unfortunately, the house of cards did come crashing down. Says Carreyrou: 'On March 14, 2018, the Securities and Exchange Commission charged Theranos, Holmes and Balwani with conducting 'an elaborate, years-long fraud.' In a civil settlement, she was charged $500,000 and forced to relinquish control of the company; it is suing Balwani. On the criminal side, in June, the US Department of Justice charged Holmes and Balwani with two counts of conspiracy to commit wire fraud, and nine counts of wire fraud; if convicted, they could face years of jail time. The FDA shut down its labs for non-compliance. On 4th September, 2018, the Wall Street Journal reported that Theranos was ceasing operations. Theranos had burned through almost a billion dollars of risk capital.

Who screwed up? In Carreyrou's telling, it is a fair question whether the young Elizabeth Holmes was an 'innocent ingénue with big dreams' manipulated by Sunny Balwani who played the role of a Svengali. But he concludes that while Balwani may have been a bad influence, 'it was Holmes who was the manipulator. One after another, she wrapped people around her finger and persuaded them to do her bidding'. He even wonders if she is a sociopath.

Therein lies a cautionary tale for all of us who lionise India's unicorns. Who knows what is happening behind the scenes? The tales of lobbying, manipulation and outright fraud in the lightly-regulated Indian environment will probably become great business school case studies one day.

Till then, we have Bad Blood as a cautionary tale. It is well written, but the author's animosity towards Balwani is jarring—he only 'barks', never speaks; he is a 'diminutive figure with the angry scowl who had terrorized Theranos employees'. Perhaps Carreyrou had been bullied by Balwani; but he allows his dislike of Balwani to bleed into a dislike of Indians. A number of Indians worked at Theranos, but he dismisses them as 'the Indians whom Balwani had hired', only grudgingly naming a couple of them, Suraj Saksena, Shaunak Roy (a founder, no less), a 'man named Samantha Anekal', and Anjali Laghari.

On the other hand, some Americans are lovingly described, in terms of their physical appearance and backgrounds. Still, almost all the characters in the book are unidimensional stick figures juxtaposed against the villainous, dictatorial evil duo of Holmes and Balwani. For a couple of women, he emphasises the fact that they have wives (well, that must be so Silicon Valley progressive!).

These are nits. Bad Blood is a page-turner, although Carreyrou needs to work on character development before he writes the Great American Novel.