The Cult of K

India too succumbs to the invasion of South Korean cosmetics

Aekta Kapoor

Aekta Kapoor

Aekta Kapoor

|

12 Dec, 2018

Aekta Kapoor

|

12 Dec, 2018

/wp-content/uploads/2018/12/CultK.jpg)

TWO YEARS AGO, civil engineer Shelley Nayak woke up to face an uncomfortable truth in the mirror: she had adult acne. Nayak set about looking for creams and potions, met dermatologists, and scoured the internet for home remedies, none of which worked. That’s when she came upon several articles on K-beauty (the hashtaggable collective noun for South Korean beauty products), and decided to give Korean skincare a try.

“I tried out almost 200 products over a year,” says the 27-year-old who works as a senior project manager at a Noida-based civil planning firm. “It was a trial and error process. There was no information on the internet and in offline stores about what products would suit me, and K-beauty brands don’t spend too much on marketing so very few people knew about them,” she explains. She began writing about her experiments with K-beauty on her blog Skbbi.com and on Instagram. Within a short period of time, she developed quite a following, and is now considered a veritable authority on K-beauty in India.

Nayak was one of the early adopters of the K-beauty trend that’s now well- entrenched in urban Indian pockets. Though South Korea’s best-known beauty label Innisfree had entered Indian markets as far back as 2013, the trend took off in a major way in mid-2017 with more and more millennials purchasing K-beauty brands directly from Instagram sellers, even if they had to pay extra in customs and delivery costs. Soon, e-commerce beauty vendors joined in, and this autumn- winter, with the successful staging of five K-BeautyCons across India, Korean beauty has truly arrived on Indian shores.

Nayak’s acne improved and what had begun as a necessity soon became “an expensive hobby”. “I spend half of my salary on K-beauty,” she confesses, adding that she does most of her shopping through Instagram and a few multi-brand e-retailers like DaisySkinFix.com and BeautyBarn.in. Owing to her “engineering mentality”, she is fastidious about studying the ingredients list and understanding their effects on the skin. “I don’t need to go to salons anymore,” she says.

The quality of ingredients is, in fact, the key USP of K-beauty products. Thanks to South Korea’s stringent manufacturing policies, and a highly competitive industry with more than 4,000 beauty companies supplying to buyers worldwide, K-beauty is considered the epitome of high-quality skincare. Most of it is based on nature- derived ingredients and not lab-produced chemicals. And because these companies spend far more on research and development than advertising and marketing, K- beauty has built a reputation for true value with little or no optics.

Global best practices indicate that brands must list the contents of all beauty products on the label in order of composition, from the most to the least. Unlike India and other countries, where the list of ingredients of off-the-counter personal care products often starts with ‘aqua’, indicating that the product you are purchasing is largely water, K-beauty products are rather more forthright. For instance, a bottle of CosRX Advanced Snail 96 Mucin Power Essence actually contains 96 per cent snail secretion filtrate, which is well-known for its hydration and anti-ageing properties. What you see on the label is what you get.

Research into the ingredients comes at a cost, of course. But K-beauty brands score on this parameter as well since a single jar of cream goes a longer way due to its potency, and the price tag is still less than that of Western luxury brands and their closest competitors, the Japanese (unsurprisingly termed J-beauty). Korea and Japan are the only two countries in the world that require a certification for producing and retailing anti-ageing skincare.

In fact, some Korean manufacturers also supply potent lotions and serums to the medical community in Japan. One of them, She-Skin, a Korean firm run by a family of doctors, has been supplying highly concentrated healing and anti-ageing potions to dermatologists for the past decade or so. Their second-generation entrepreneur Noel Ham decided to take his family’s heritage a step forward into B2C skincare. After studying economics in Virginia, USA, he took up a job at a gaming support company in Benguluru, India, to broaden his horizons. After three years here, he was struck by how popular K-beauty was among his friends. “Every time I went back to Seoul, I was requested to bring back tons of beauty products,” recalls the 29-year-old.

“I tried out almost 200 K-beauty products in a year. Now I spend half of my salary on them” – Shelley Nayak, founder of K-beauty blog Skbbi.com

Ham tied up with Kunal Puri, a former colleague in Benguluru, to launch Seoul- Made, a range of high-end anti-ageing skincare made in Korea for retail in India. The brand was launched at the first edition of K- BeautyCon in India held at the Palladium Mall in Chennai in September 2018. Since then, the founders have approached over 30 luxury stores across the country.

“I have seen advertisements for anti-ageing products in India, but these products aren’t really anti-ageing,” he says. For any lasting effect, products need nano-particles that deliver ingredients deep into the skin, which is completely missing in regular FMCG products, he informs. “But these advertisements do create awareness about the need for anti-ageing products, and when customers evolve, the demand shifts to higher quality products. And I wanted to be there at the foreground when that happens and the industry booms in India,” he shares.

Seoul-Made is especially looking towards Northeast India, where it has participated in every K-BeautyCon till date. After Chennai, the beauty convention covered Nagaland, Sikkim, Mizoram and Manipur in just three months. And for good reason. The Northeast has a special relationship with all things Korean, especially Manipur, where the local government banned the screening of Bollywood movies and Hindi television soaps 18 years ago. Youngsters there turned to Hollywood and Korea for their pop culture needs: K-dramas (television serials) play on the local TV channels and K-pop (music) is well-entrenched part of local lifestyle. Many of those born after the Hindi ban speak fluent Korean now. “We even share the same facial features, so there’s a good connect with Korean beauty brands,” says Ham in half-jest.

Ham is all praise for the organisers of K-BeautyCon, a young team of driven professionals looking to get Indians the best of Korean skincare. The convention is headed by Jennifer Wangkhem, a 27-year-old costume stylist and founder of JW Creatives, a fashion production agency. The Imphal- born JNU alumna had long known that northeasterners, though aware of K-beauty, had no idea where to buy products. “They were mostly buying them through illegal sources, or else purchasing them at very high prices through importers,” she says.

Sensing the demand, the convention brought together buyers with legal distributors and brands. Six more K-BeautyCons are now scheduled over the next few months in Delhi, Mumbai, Ahmedabad, Chandigarh, Pune and Kochi. Wangkhem’s firm also helps Korean brands establish connections in Indian cities with local vendors, luxury stores and cosmetics shops.

I T HELPS THAT there is a burgeoning e-commerce industry coming up, catering especially to K-beauty fans. Besides Nykaa.com, one of India’s largest beauty e-retailers, smaller e-stores specialising in K-beauty have also joined the fray. Toina Kinimi, founder of the very popular BeautyBarn.in, launched her e-store in 2017 after trying out K-beauty and experiencing surprising benefits for herself. Having studied in Bengaluru and Mumbai, she had returned to her native Nagaland to teach in an institution and support her young husband Inoto Kinimi in his manufacturing business. But so successful was her K-beauty e-venture that her husband has now joined her full time as her firm’s managing director.

“I had such bad acne at one point that I couldn’t even sleep at night. I owe my life to K-skincare” – Kanika Aggarwal, K-beauty fan and blogger

The 31-year-old Dimapur-based entrepreneur also retails K-beauty at three stores in the Northeast with a team of just 10 full-time staffers. “We have customers from all across India through our online store, mostly men and women in the age group 18 to 50 years,” she says. Many of these customers have a specific skin issues, and reach out to Beauty Barn for advice on what ingredients they should use. To keep it user-friendly, the product descriptions on the site also mention the skin concerns that the product addresses.

All her products are registered with India’s Central Drugs Standard Control Organization (CDSCO), and despite high custom duties, the retail price works out to be quite reasonable as compared to illegal distributors. “Price start from as cheap as Rs 100 for sheet masks to Rs 2,500 for premium products,” says Kinimi, who lists CosRX, Dear Klairs, By Wishtrend, Tiam and Some By Mi as her top-selling brands.

Though e-commerce stores such as hers may sometimes deal with Korean brands directly, they mostly rely on Limese as their distributor for K-beauty products. The Indo-Korean company, set up by three Indian School of Business alumni, bridges the gap between the supplier and buyer, besides also manufacturing their own range of Limese skincare. “We represent nine brands besides our own,” says COO Kaushal Shah, adding that it takes three months to get a CDSCO licence for each product. The products they distribute are carefully curated for their popularity and efficacy worldwide. “We observe the top- selling Korean brands in the US, and base our research on them. But we also keep the Indian buyer’s sensibility in mind when it comes to price points,” he says.

Now supplying top-rated brands such as Dear Klairs, Coony and A by Bom to e-retail giants such as Nykaa, Jabong and Myntra, Shah’s company is looking to tie up with smaller distributors—both offline and online. “Tier 2 and 3 towns and those in the Northeast are on top of the list,” he says. Shah is unconcerned about any backlash from the local Indian beauty industry as K-beauty is still a niche trend, but he sees a huge scope for the future. “Once people start using these products and see the results, they always come back for a repeat purchase,” he says, adding that Dear Klairs itself earned his company Rs 6 crore worth of retail sales in the eight months that they have been distributing in India.

Typical of skincare brands back in Korea, retailers and distributors in India have also not felt the need for any marketing or advertising, as the demand is mostly organic, and keeping up with the existing demand is enough to rake in profits. “Vendors like Nykaa create quite a lot of awareness about Korean brands through their monthly ‘K-beauty Day’ and through their network of bloggers,” adds Shah.

B LOGGERS ARE THE real drivers of demand for K-beauty. Mostly women in their twenties and thirties, they fulfil the market need for an authority on the subject in the absence of ads or direct sales support. Readers follow them for reviews of products and suggestions on what ingredients would suit their skin. Unlike celebrity endorsements, bloggers— who have personally tried the products they talk about—play the role of informal (and unpaid) brand ambassadors.

One of them, Kanika Aggarwal, says she “owes her life to K-skincare”, and is pretty much addicted to all things Korean. “I had such bad acne at one point that I couldn’t even sleep at night; I couldn’t bear the pain if my face rubbed against the pillow,” says the 30-year-old Delhi-based architect and fashion designer. “I was on steroids, but my cheeks were always blood red.”

Aggarwal has followed K-dramas on YouTube since 2011, and was accustomed to seeing visuals of young people—both men and women—using sheet-masks, such as before heading out on a date, or going through the famous 10-step Korean skincare routine. “It’s a very equal society, and notions of masculinity and femininity are more fluid than those in India,” she observes. She also follows K-pop and had noticed that even male performers used colour cosmetics unabashedly and were completely “cool” with displaying their favourite serum or face creams. The constant barrage of such lifestyle habits left her with much curiosity about K-beauty.

“Last year, I went to a K-pop concert in Singapore, and couldn’t resist spending over Rs 40,000 in Chinatown on K-beauty products. They were much cheaper there than in India,” says Aggarwal. Over the next few months, her skin showed such a drastic improvement that her parents no longer complain about her expenses. At any given time, she says, she has a stock of 200 sheet masks besides various other lotions, gels and ampoules. “I’ve found a saviour,” she says, adding, “Now that I’ve started using K-beauty, I can never use regular Indian beauty brands.”

Aggarwal is also a coordinator for one of many K-pop ‘fandoms’ in India, which means she interacts frequently with thousands of teens and young adults who are crazy about Korean music. She attributes the burgeoning interest in K-beauty in large part to the growing interest in Korean pop music, fashion and television shows. She herself has been studying the Korean language for two years, and calls K-culture a trap. “If you get into one thing, you’ll be dragged into it all the way. All my money goes to South Korea,” she jokes. The K-beauty industry must be laughing all the way to the bank.

About The Author

CURRENT ISSUE

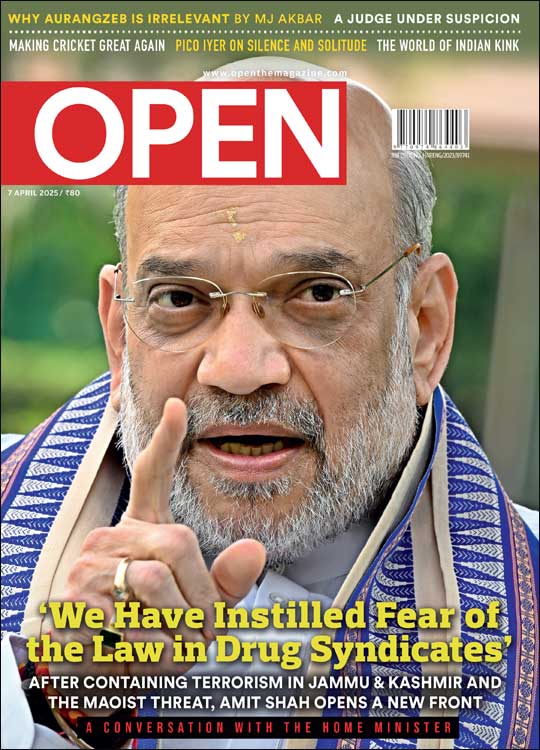

‘We Have Instilled Fear of the Law in Drug Syndicates,’ says Amit Shah

MOst Popular

4

/wp-content/uploads/2025/03/Cover_Amit-Shah.jpg)

More Columns

BJP allies redefine “secular” politics with Waqf vote Rajeev Deshpande

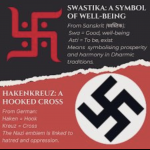

Elon Musk attracts sharp attack over ‘swastika’ from Indians on social media Ullekh NP

Yunus and the case of a "land locked" imagination Siddharth Singh