Green Entrepreneurs

If you need convincing that going green can spin money as well, it’s here. A good look at ecological enterprise in India.

Ninad D. Sheth

Ninad D. Sheth

Ninad D. Sheth

|

23 Sep, 2009

Ninad D. Sheth

|

23 Sep, 2009

/wp-content/uploads/2015/11/green-entres-3.jpg)

If you need convincing that going green can spin money as well, here’s proof.

Green, most calming of colours, has many shades. It is the colour of money. It is also the colour of the environment. For too long, the twain have not met. However, with global warming and an energy crunch, sustainable environment friendly businesses have begun capturing the world’s imagination.

Across India, entrepreneurs are investing talent, technology and loads of cash to kickstart green businesses. Wind turbines hum in mad whirls in Kanyakumari, Tamil Nadu. Jatropha farms have sprung up on barren land to provide raw organic matter for ethanol in Rajasthan. A business of Rs 1,000 crore in annual revenues has arisen from machinery that converts sugarcane to fuel in Pune, Maharashtra. Eco-tourism that recycles waste and measures your ecological impact is proving a big draw in Kerala. An Indian-Chinese collaboration is betting big on solar power in Hyderabad, Andhra Pradesh. A firm is investing Rs 1,500 crore on the latest solar technologies in Noida, near Delhi in Uttar Pradesh. And you can plug your electric car as if it’s a cellphone for a recharge just off busy Brigade Road in Bangalore, Karnataka.

And it’s not only businessmen. Moneybags are pouring money into green businesses like there’s no tomorrow. Worldwide, a record $160 billion of investment went into alternative energy resources in 2007. India too has seen interest from banks, venture capitalists and sundry investors. Legendary venture capitalist Vinod Khosla, who helped found Sun Microsystems and Google, is now looking at alternative energy. “India is naturally a huge market for alternative energy,” he says, “Biofuels offer the potential to alleviate the high cost of oil.” And when Khosla makes a move, others follow.

The list of green investors is both long and impressive, from UTI Ventures in Bangalore to Aviva Insurance and Rabobank in Mumbai. Funding is not a constraint. Says Kwawu Mensan Gaba, an energy specialist at the World Bank, “There is definite interest in green ventures in India. The World Bank is working on a Low Carbon Growth Strategy Study, and closely following up key measures taken by the Indian government. We will adjust our Country Assistance Strategy accordingly.” On that buoyant note, let’s move on to the case files:

WIND BENEATH THE WINGS

Worldwide, wind energy is in infancy as an industry. At Suzlon, it is reaching maturity. This Pune-based company is the world’s fifth largest wind-turbine maker, with 14 per cent of the world market to itself.

In India, its market share is 57 per cent. And to think that it all started in Gujarat out of a necessity that Tulsi Tanti, the firm’s founder, turned into a virtue—and later a fortune.

Tanti wanted power for his textile business, fed up as he was with power cuts. Being an entrepreneur, he did not wait for the state to solve his problems. Instead, he set up a wind energy farm. Since then, Tanti has been setting up windmills at a furious pace. “We are now looking at growth,” he says, “Suzlon aims to be among the top three wind power companies in every market that it is present. We aim to go global in a big way, taking wind power to the world as Asia’s largest international wind-turbine maker. Suzlon currently has operations across 21 countries and five continents, and will reach over 40 countries in the next two to three years.” Its acquisition of REpower is part of its global gameplan.

Today Suzlon feeds electricity into India’s power grid. Its installed capacity has soared from 3 mw in 1995 to 7,500 mw today. There have been hiccups, though. Fixing quality gaps has taken up Rs 500 crore, even as the US wind major Edison recently cancelled a large order. Worse, usable space for windmills is turning scarce, which complicates matters for a business so dependent on open land.

Yet, wind power makes for a clean and rewarding business. By some estimates, more than two-thirds of all investment in alternative energy across the world is directed towards this model. With a client list of firms such as Tata Power, Reliance Industries and ONGC, and orders of nearly $3 billion, Suzlon is likely to keep its fans turning.

POWERING TOMORROW’S FUELS

Vinod Khosla, one of the co-founders of Sun Microsystems and an investor in Google, is now eyeing alternative energy. Khosla spoke to Open about the future of the sector in India.

Q How important is the Indian market for green technologies—in particular wind power and ethanol?

A India is a huge market. When you have one billion people in an economy growing at 7 per cent a year, there is significant scope for change. From an oil replacement perspective, most of the 800 million cars that will be sold globally over the next 15 years will be in India—that will lead to huge demand, putting India, already an oil importer, under further strain. Biofuels, including ethanol, offer the potential to alleviate the high cost of oil with a carbon-abatement option.

Q What are Khosla Ventures’ investments in this sector in India?

A Khosla Ventures is invested in Praj, which manufactures ethanol plants, as well as another smaller investment in India. We are also looking at new opportunities all the time from green entrepreneurs in different fields.

Q Are new technologies likely to drive down the per unit cost of ethanol? Is there any single breakthrough technology likely to come within the alternative energy space in the near future?

A They already have. We think we will see $1.25 per gallon as ethanol cost (in 2006 dollars) within a few years. There are multiple startups working in the space with a variety of technologies, including a few of our own—Range Fuels and Coskata.

Q In terms of government policy, what can help nurture nascent Indian alternative-energy firms?

A I think the Indian government has to recognise that it’s at a crossroads. The country is on the verge of a huge leap forward with a rapidly growing middle class. The recently released Indian Climate Change Plan has some good ideas.

GOD’S GREEN COUNTRY

Jose Dominic, 50, managing director of CGH Green, was at it long before eco-tourism came into vogue. “We convinced the government not to open a hotel in Bagaram Island in Lakshadweep,” he recounts, “We set up a habitat instead, and put in place strict effluent parameters. We were convinced that there was a reasonable market out there for properties that conform to environmental standards.”

That first step in Lakshadweep, an archipelago in the Arabian Sea off the coast of Kerala, began his eco-friendly journey. His flagship destination, however, is a lake resort in Kerala called Marari Beach. It’s a resort alright—there’s the sun, the sand, and the breaking waves amidst the calm Kerala coastline. It’s an interesting experience for the first-timer. As a welcome package, you are given a step-by-step rundown of your ‘carbon footprint’: how much you produce in waste, how much electricity you consume and so on, and how you can redeem yourself on a green holiday. “Habitat interaction, where the tourist is made aware of his carbon footprint, leads to a new kind of evolved tourist,” says Dominic, “Sure, there is an onus on the tourist, but visitors do their bit and quite enjoy it once briefed.”

The beach resort is considered one of the most environment friendly tourist sites in Asia. It has investments in pollution control, waste management and water recycling, all of which combine to reduce the carbon print of guests to almost zero. As for the accommodation, it is modelled on fishermen dwellings in nearby Mararikulam, with modern amenities to go with the traditional form. So the bathrooms have modern fixtures in an open-roof format, while the rooms are covered by palm thatch.

The resort grounds also host India’s largest butterfly among 100 odd species of these winged beauties. It has a water purification plant that recycles and purifies 80 per cent of the water used. There is a sericulture area with three pits that recycle organic waste into manure for a 30 acre organic farm that provides the kitchen with vegetables. Says Dominic, “Once you have been on a green lifestyle, it is not so easy to forget it even when you go back home.”

Analysts believe that the market for green tourism in India is set to expand fast. This has already set off a hunt for pristine properties across the country, though environmentalists worry about excessive tourist flows leading to secondary degradation effects, which would defeat the original idea. While destinations like Bhutan and Mauritius control their inward tourism flow, places in India like Goa and Kerala are at threat from global swarming. Crowds, that is. Luckily for CGH Green, Marari Beach is an exception.

THE SWEET SMELL OF A NEW FUEL

To understand the ethanol story, you have to go back in time. Two products that defined the modern age of industrial production, the Ford Model-T car and the Nazi V2 rocket, were both designed to use ethanol as part of their fuel mix. The idea has been around awhile, clearly, but mass adoption is recent.

Tucked away in Pune, Praj Industries is projecting a huge switchover to ethanol-mixed fuels. With a turnover of Rs 108 crore and an order book of nearly Rs 950 crore, this company was once a supplier of equipment to India’s alcohol industry. Now, promoter Pramod Chaudhary foresees demand swelling as petrol ‘doping’ catches on, which involves blending fossil fuels with ethanol. This makes sugarcane, corn or jatropha a substitute for crude oil. Praj supplies equipment to manufacture ethanol.

Says Chaudhary, “Two factors are propelling our growth. First, volatile oil prices give us cost competitiveness. Second, government policy currently mandates 5 per cent compulsory blending of ethanol in fuel, while in Japan it’s 10 per cent in Brazil 20 per cent. Even in India, I see a trend where greater blending will be the way forward.”

If there’s a problem with en masse ethanol adoption, it is that the organic raw material required must be grown on land that could be used for food cultivation. This raises the spectre of food scarcity in poorer countries. But Chaudhary disagrees. “In India, ethanol is produced from a non-food source of feedstock, namely molasses,” he says, “The alcohol industry in India is well established and hence expanding into ethanol has not been an issue, as has been evident since 2003 when the government mandated 5 per cent ethanol blending.” Praj claims to have global scale, and half its revenues are from exports. It also boasts of joint ventures in the US and EU, besides Brazil—the world’s largest ethanol market.

One worry for Praj is that India’s ethanol policy lacks clarity. Ethanol adoption has been patchy at best, and observers suspect that its growth has been in spite of government policy, not because of it. A CII report says that ethanol needs ‘goods’ status and freedom from tax anomalies to emulate the Brazilian or Japanese models. Praj, meanwhile, is banking on the green movement to cast a darker shadow on fossil fuels.

CHARGED UP WITHOUT PETROL

Bangalore: Chetan Maini is a man in a hurry, though he doesn’t always look it. At his automobile manufacturing plant located just outside polluted and congested Bangalore, he is busy talking to engineers at the assembly line. Listen carefully, and you detect more than a hint of pride in his manner. His electric-powered car Reva has already won awards at motorcar shows around the world. Now he is concentrating on the real thing—market share. “Reva is not just a good idea,” says Maini, “with the worldwide concern for global warming, it is a real alternative.” With crude oil given to price spikes of the kind seen last year in the international market, “It is also economic sense”. Oil price levels may have cooled significantly since their 11 July 2008 peak of $147 per barrel, but the volatility is enough to give Maini confidence in his project. The company is set to expand production capacity from 300 to 30,000 units a year. For this, he has secured $25 million in investment from Draper, a venture fund reputed to stay ahead of the curve (it made rich pickings off Rediff during the dotcom boom). Clearly, he knows what he’s doing.

Reva is a genuine wonder. At 40 paise to the km, it is the world’s most cost-effective motor vehicle. What’s more, the firm has already got ten key patents. The only hitch is the life of its battery. The car’s range is 80 km, much too less for a metropolis with traffic jams as part of the motoring routine. What if you get stuck midway? Maini’s solution: “We are putting in 200 plug points in Delhi and an equal number in Bangalore. A rollout for other cities is also planned over the next three months. Our research teams are working with technology firms and the one-point agenda is to increase the life of the battery. We believe that technology will solve this issue sooner rather then later.”

With enough recharging points, it could become the eco-conscious choice. It’s already a hit of sorts in London, where if you drive one you do not have to pay the dreaded car tax in central London. If you go green, you go free. In India, actor Akshay Kumar and Union Minister for HRD Kapil Sibal are notable converts.

Meanwhile, Reva is working on technology for a lithimine battery option that promises more speed, enhanced battery life and quicker charging. The firm soon expects to launch a new car with a new battery. Other car companies are watching. Of that, you can be sure.

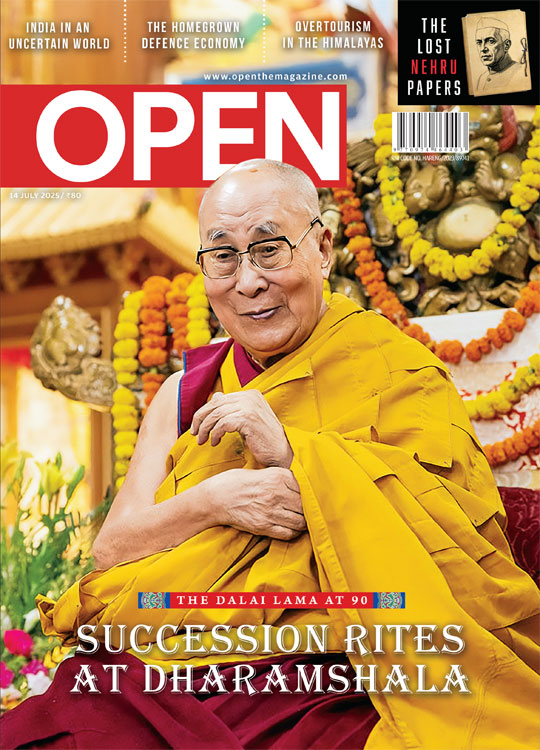

/wp-content/uploads/2025/07/Cover_Dalai-Lama.jpg)

More Columns

From Entertainment to Baiting Scammers, The Journey of Two YouTubers Madhavankutty Pillai

Siddaramaiah Suggests Vaccine Link in Hassan Deaths, Scientists Push Back Open

‘We build from scratch according to our clients’ requirements and that is the true sense of Make-in-India which we are trying to follow’ Moinak Mitra