Sour South: Is there a bias?

Most southern states are up in arms against the disadvantage they fear they might suffer if the Central pool of tax funds is shared the way they suspect New Delhi wants. Their complaint is that they are being penalised for their good performance. Is there an anti-south bias?

Ullekh NP and Siddharth Singh

Ullekh NP and Siddharth Singh

Ullekh NP and Siddharth Singh

|

12 Apr, 2018

Ullekh NP and Siddharth Singh

|

12 Apr, 2018

/wp-content/uploads/2018/04/North-South1.jpg)

‘GLORIFIED MUNICIPALITIES’ is an expression that Kerala’s Finance Minister TM Thomas Isaac has lately been using to describe what he claims would be the likely fate of India’s better-performing states in the face of escalating ‘fiscal terrorism’ by the Union Government. What has aroused the ire of this economist-politician is an order issued by the President constituting the Fifteenth Finance Commission (the panel that recommends how to share the Central pool of tax funds among states), whose Terms of Reference (ToRs) prompted him to convene a first-of- its-kind conclave of finance ministers of southern states on April 10th. Last year, Isaac had earned plaudits from Prime Minister Narendra Modi for his quality inputs during discussions held in the run-up to the introduction of the Goods and Services Tax, an indirect tax that has replaced several others in the country since. But now, he is at odds with the Centre.

The one-day meet held in Thiruvananthapuram, attended by leaders of Karnataka, Andhra Pradesh and Puducherry, apart from Kerala, concluded with a decision to call another such gathering in Visakhapatnam within a fortnight to chart out an action plan to voice the concerns of ‘progressive states’ that they argued would bear the brunt of a new ‘aggressive and unitary’ posture adopted by the Centre.

For the next summit, Isaac hopes to enlist Tamil Nadu, which pulled out of the April 10th one despite having initially agreed to participate, as well as the northern and eastern states of Delhi, Punjab, West Bengal and Odisha. He has said he is not averse to the idea of inviting BJP-ruled states, such as Goa and others, to discuss “injustices” meted out to states doing well on the achievement of social development targets.

In Thiruvananthapuram, leaders of Karnataka and Andhra Pradesh spoke out against a new brand of policy that they contend is emerging: of the Centre penalising successful states and incentivising laggards. In an interview with Open, Isaac says that neither he nor others at the conclave are against the idea of equity, nor are they against helping states like Bihar and Uttar Pradesh emerge from their backwardness.

Krishna Byre Gowda, the agriculture minister of Karnataka, has been quoted as saying that the group voicing dissent is ready to engage with the Fifteenth Finance Commission in an effort to have their grievances redressed. While a win-win solution is possible, goes his argument, the Union Government should not create winners and losers. His disgruntlement stems from the ToRs. These, he alleges, are designed to hurt progressive states for they give the Centre the discretionary authority to “play as it pleases”; by this, he implies it may want to favour some and disadvantage others. “By weakening the strongest parts of the Union, you are weakening the Union itself,” he states.

Speaking to Open, C Ponnaiyan, a former finance minister of Tamil Nadu and organising secretary of the AIADMK who is now a close associate of the state’s Deputy Chief Minister O Paneerselvam (who also hold the finance portfolio), calls the conclave a “paper tiger”. It is not unusual for Union governments to display such unitary tendencies, he says, especially vis-à-vis states south of the Vindhyas. S Thirunavukkarasar, a Congress veteran from the state, says that the Tamil Nadu government’s “last-minute” refusal to attend the conclave of April 10th smacks of slavish mentality and is symptomatic of the state’s current lack of strong leadership. Rivals decry the post-Jayalalithaa AIADMK, which holds power in Chennai, as a collective of indecisive leaders with no charisma. “They are scared to even stand up for their rights,” says a Congress leader, “After all, Tamil Nadu is one state that will be worst hit by the ToRs.”

Andhra Pradesh’s Finance Minister Yanamala Rama Krishnudu, who attended the meet, has also lashed out at Centre for using the Finance Commission as a “political tool”. So has Puducherry Chief Minister V Narayanasamy, who made his point clear in his address at the gathering.

The conclave concluded with a decision to call another gathering to chart out an action plan to voice the concerns of ‘progressive states’ that they argued would bear the brunt of a new ‘aggressive and unitary’ posture adopted by the Centre

AT VISAKHAPATNAM, the group expect to draft a joint memorandum against the ToRs they have such strong objections to. As Kerala’s Chief Minister Pinarayi Vijayan tells Open, “This is not just a south-versus-north issue, but a Centre- state relations debate.” For some southern states, the contentious clauses of the ToRs include the use of ‘population data of 2011 while making [the Commission’s] recommendations’, as opposed to the figures of 1971 or a mix of 1971 and 2011. Some states are also peeved that the ToRs lay down conditions for tax sharing, which they say is a violation of the Constitution. According to Isaac, the document suggests that the increase in states’ share of tax revenue from 32 to 42 per cent made by the previous Commission was an excessive step. The group also condemns the attempt to boost Centrally sponsored schemes, arguing that several progressive states have their own schemes that deliver better outcomes.

The question, then, is: how justified is this anger?

At an administrative level, the controversy over the use of population data from the 2011 census instead of the 1971 one appears superfluous. Under the ToRs of the previous Finance Commission, it was asked while making its recommendations to ‘generally take the base of population figures as of 1971 in all cases where population is a factor for determination of devolution of taxes and duties and grants-in-aid’. But those ToRs had also added that ‘the Commission may also take into account the demographic changes that have taken place subsequent to 1971’. On April 10th, Union Finance Minister Arun Jaitley clarified this point in a Facebook post, in which he said, ‘The 14th [Finance Commission] had no specific mandate for using the 2011 census. Yet, the 14th FC rightly used the 2011 census population data to capture the demographic changes since 1971 to make a realistic assessment of the needs of the States. It allocated 10% weight to the 2011 population.’

“A win-win solution is possible and the Centre should not create winners and losers. By weakening the strongest parts of the Union, you are weakening the Union itself” – Krishna Byre Gowda, agriculture minister, Karnataka

The real reasons for the disquiet—apart from the usual myopic political ones that arise close to elections—are different. The forum of leaders who met in Thiruvananthapuram had even hinted at them. Kerala’s Vijayan was explicit on that score when he said, “Reframing of the Terms of Reference is imperative to strengthen the federal structure of the country on the one hand and to reinforce the unity and integrity of the nation on the other.”

There are two ways to look at the issue. One is to consider it from the old lens of the Union Government trying to control the states. There’s plenty in the ToRs that can be spun that way. Take the clause that asks the Commission to consider the ‘conditions that Government of India may impose on the States while providing consent under Article 293(3) of the Constitution’. This article limits the power of states to borrow money if they have not fully repaid a loan given to them by either the Union Government or any other lender to which the Centre had provided its assurance as debt guarantor. The Constitution empowers the Union Government to lay down the parameters under which such consent can be given, something which it has asked the Fifteenth Finance Commission to do.

The other way to look at the issue is to consider this an attempt to nudge the states to carry out economic reforms that they have been reluctant to. This is the nub of the problem: the Centre is under constant pressure to keep the country’s overall fiscal deficit— the combined deficit for the Union and state governments— under check. In recent years, states have recklessly been spending, which complicates the overall task of macroeconomic management— keeping both the deficit and interest rates low. This has an adverse impact on the whole country’s economic growth.

“Neither I nor others at the conclave are against the idea of equity, nor are we against helping states like Bihar and Uttar Pradesh emerge from their backwardness” – TM Thomas Isaac, finance minister, Kerala

That overriding concern is clear from New Delhi’s attempt to craft performance-based incentives that the Finance Commission has been tasked with. Some of them are political red rags. For example, the Commission has been asked to take into account ‘control or lack of it in incurring expenditure on populist measures’ by the states. Anyone familiar with India’s political economy knows that at the state level, the name of the game is to spend and win polls, with the expenditure calibrated to get the biggest bang for every buck. To expect that a reversal of populist schemes would be accepted tamely by the states—even if a body of technocrats has been given the mandate to look at the issue—is politically naïve.

There are a slew of such ToRs for the Commission, something that no government in the past has had the courage to ask for. In that sense, the present dispensation at the Centre has bitten the bullet of moderating populism. A look at these ToRs shows that claims of partiality towards northern over southern states are unfounded. To cite one example, the Commission has been asked to consider proposing incentives that take into account ‘efforts and progress made in moving towards replacement rate of population growth’. If such measures are framed, accepted and implemented by the Union Government, then UP and Bihar would be the biggest losers, contrary to the furious debate about southern states ‘subsidising’ northern laggards.

What has been forgotten in the noisome north-versus-south argument is that all constitutional bodies use a number of factors while deciding on issues within their purview. The Finance Commission is no different. If population is a factor for deciding devolution of taxes and so on, then so are countervailing and special circumstances as well. This time, the Commission has been asked to look at incentives— or more accurately disincentives—on managing population. After Andhra Pradesh was divided in 2014, the previous Finance Commission was asked to look into the availability of resources after the division of the state well after it had begun its proceedings. When the final award was presented in December that year, Andhra Pradesh was given Rs1.69 lakh crore as its share in the divisible pool of Central taxes from 2015 to 2020, a substantial increase over the Rs 1.14 lakh crore awarded by the previous Commission. In addition, the state was also given help to bridge its revenue deficit due to revenue losses after Telangana was hived off.

Yet, four years later, Andhra Pradesh Chief Minister N Chandrababu Naidu argues that tax revenues from south India are being used to fund development activities in the north. Such claims contradict other arguments made by the state. If tax collections from Andhra are disproportionately high, then surely it has enough commercial activity not to need Special Category status, which is meant for underdeveloped states that do not have such an advantage and require extra finances from the Centre. The Raghuram Rajan Committee that examined the issue of which states deserve this tag had devised an underdevelopment index based on per capita Net Domestic Product. States like Odisha, Bihar, Chhattisgarh, Jharkhand and Madhya Pradesh are far needier than Andhra Pradesh on this index, and yet, none of them qualify for Special Category status. Andhra Pradesh suffers from none of the usual debilitating features such as poor terrain, lack of development, etcetera, that many of India’s remote states do. It was a political accident that it was bifurcated.

‘The 14th Finance Commission had no specific mandate for using 2011 census. Yet, 14th FC rightly used the 2011 census population data to capture the demographic changes since 1971 to make a realistic assessment of the needs of the States. It allocated 10% weight to the 2011 population’ – Arun Jaitley, Union finance minister

Historically, none of the reasons offered by better-off states for a greater share of resources has had any merit. At one point, Punjab used to make an argument similar to the one being made now by southern states. The state’s grouse was that due to its relatively small population, it received less from the Central pool of taxes. In its support, Punjab claimed that it had 2 per cent of India’s geographic area but contributed as much as half the Central pool of foodgrains, thus playing a major role in India’s food security at a time when virtually all other states had a food deficit. Much like Karnataka’s argument about ‘progressivism’ today, what Punjab left unsaid was that its supplies to the Central pool were fully paid for by the Union Government from tax revenues raised across the country.

Meanwhile, a Government official who was closely involved in the parleys over drafting the ToRs says that the language used in the Presidential order may have aggravated matters. He says that the “original wordings” were terrible and what is in the public domain now is a “much diluted” version compared with the one “that a senior official wanted”. He also believes that certain aspects of the order need not have been there. “That includes assertions such as ‘the Commission may also examine whether revenue deficit grants be provided at all’”. In his opinion, it is not the Finance Commission that is meant to make such statements, but the Finance Ministry. He also takes exception to conditions placed on states to avail of loans, and is piqued that the ToRs refer to the earlier Commission while the new one ought to have started off on a clean slate. Such criticisms apart, this official is more worried that institutions are being undermined by various forces even though contentious issues can be sorted out through confabulations. Though he does not elaborate, he says that the Special Status demand by Andhra Pradesh could have been handled better had a senior official not shown lack of dexterity.

As for the language and content of the ToRs, NK Singh, chairman of the Fifteenth Finance Commission, would like to remind everyone that the body has no role in drafting them. “We just receive it from the President after it has been cleared by the Cabinet,” he tells Open. Likewise, Dr Anoop Singh, a member of the Commission and adjunct professor at Georgetown University, has this to say in an email response: ‘I should reiterate that we are guided by and bound by the terms of reference given to us by the President.’

Bibek Debroy, head of the Economic Advisory Council to the Prime Minister and a Niti Aayog member who has often spoken of a trade-off between equity and efficiency, tells Open that states should ideally present their case to the Finance Commission. “One should recognise the constitutional role of the Commission,” he says, “All states invariably hold discussions with [it], and therefore all grievances have to be submitted to it.” Subhash Chandra Garg, secretary, Department of Economic Affairs, has not responded to Open’s specific queries so far on three issues that have irked the southern states: the ToR’s increased stress on Central schemes over states programmes; the suggestion to relook at the 42 per cent tax devolution to the states; and a likely review of the provision of revenue deficit grants. Another government official, however, says that the Centre has genuine reason to worry about reduced resources at its command.

Professor Prerna Singh of Brown University, the author of How Solidarity works for Welfare: Subnationalism and Social Development in India, says it is true that some southern states for decades have been characterised by much lower fertility rates and higher social indicators than northern states, and that these have been the result of explicit social policies. “These social policies have required a great degree of political will to enact and societal mobilisation to implement,” she says, “Southern states such as Kerala, and also Tamil Nadu, made social welfare a priority in the decades after Independence and devoted precious budgetary outlays to social schemes. At this time, some of these southern states such as Kerala were actually in a more precarious financial position than north-central Indian states such as UP. Yet, they chose to make this commitment to social welfare. And so it is understandable that they do not wish to be penalised for this early and sustained commitment to social welfare that is reflected in their lower fertility and higher welfare rates today.”

However, as Professor Singh adds, “It is important to keep in mind that talking about ‘laggard’ northern states versus ‘progressive’ southern states obscures important differences between these states within these regions. Andhra Pradesh, for example, at many points in the last few decades has been characterised by social welfare indicators at par with the Hindi heartland. In the 1990s, Rajasthan saw an important commitment to and consequent jump in educational indicators. Recently, there has emerged a significant and unprecedented focus on social welfare in Bihar.”

Andhra Pradesh Chief Minister N Chandrababu Naidu argues that tax revenues from south India are being used to fund development in the north. Such claims contradict the state’s demand for Special Category status

On the possibility of southern resentment resulting in the rise of subnationalist forces within these states, Professor Singh says that tensions between regions are not unusual in a federal set- up. “But jurisdictional changes that structurally disadvantage or are perceived to disadvantage certain regions as compared to others have historically been important triggers for the development of regional discontent. At various points in time—for example, in the 1970s—discontent because of Central policies that are perceived to disadvantage their state has fuelled subnationalism in Kerala and Tamil Nadu. Moreover, it is important to keep in mind that in India certain states have historically been the site of powerful subnationalist movements.” Her book delves into how such subnationalism has been a significant force behind the social policies of these states. “So, increased regional discontent in the context of long-standing, deeply rooted, powerful subnationalisms could be an especially potent challenge to Indian federalism,” she says.

At the moment, the divisive effects of high population in India are being debated in terms of Finance Commission awards. But there is a deeper reason behind the southern unease. In 1971, the combined population of UP and Bihar was roughly 125 million. The four southern states then, Andhra Pradesh, Karnataka, Kerala and Tamil Nadu accounted for 145 million people. By 2011, the preponderance had inverted: the two northern states now had 303 million people and the southern states (including Telangana, which was a part of Andhra Pradesh then) had 251 million. As of now, the number of seats each state has in the Lok Sabha is based on numbers from the 1971 census. The Vajpayee Government had frozen that arrangement until 2026. When a new delimitation exercise is carried out based on 2011 census data, the southern states would lose several seats in Parliament while the cumulative representation of UP and Bihar would rise substantially. Even now, the two states account for a vast chunk.

When that happens, the sheer weight of northern states in Parliament, and consequently in politics and policymaking, has the potential to overwhelm almost all others. There is virtually nothing that can be done to fix that skew. In a democracy, representation is a matter of numbers, and these favour the north. It is not clear if there is a constitutional solution for this. Even if compensatory measures are taken to assure the south its voice in national affairs (say, by granting it higher Rajya Sabha representation), it would call for a constitutional change, which would perhaps face resistance in any given political scenario. However, if the current trend of increasing northern dominance persists, geographical fissures could emerge in the country. This would pose dangers. Northern states being split into smaller ones might relieve the state-wise disparities of power, but the north-south divergence would still require other modes of addressal.

In their efforts right now, the southern states could be making a strategic mistake: if they succeed in altering the ToRs they are ranged against, the northern states may end up demanding delimitation based on the 2011 census, which would reduce the south’s influence in New Delhi. Perhaps a way to prevent that outcome is some sort of trade-off between letting states such as UP and Bihar get a larger share of financial resources now, in return for a correction in political representation at a later stage. Southern states also seem to discount the fact that the Finance Commission may make a greater allowance for ‘progress made in moving towards replacement rate of population growth’, as stated in the ToRs, than what they seem to assume.

The current debate that has generated much heat has made one thing clear: population and its political and economic effects can no longer be ignored. Left unaddressed, India runs the risk of a Malthusian quagmire.

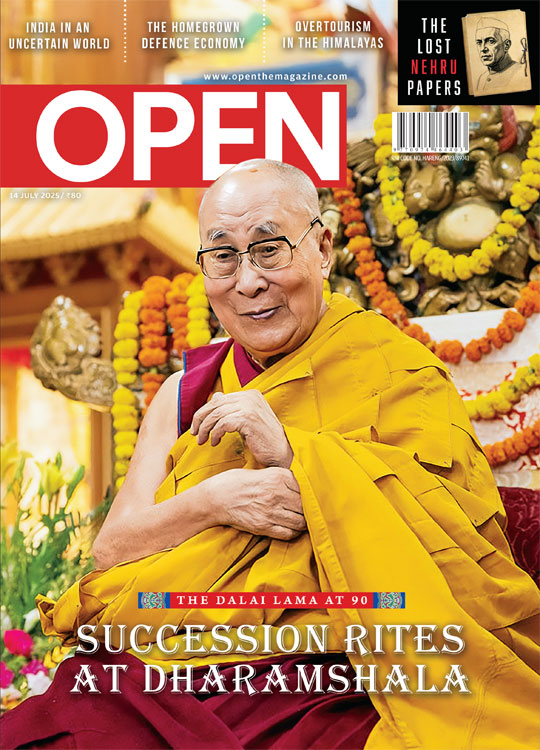

/wp-content/uploads/2025/07/Cover_Dalai-Lama.jpg)

More Columns

From Entertainment to Baiting Scammers, The Journey of Two YouTubers Madhavankutty Pillai

Siddaramaiah Suggests Vaccine Link in Hassan Deaths, Scientists Push Back Open

‘We build from scratch according to our clients’ requirements and that is the true sense of Make-in-India which we are trying to follow’ Moinak Mitra