25 Years of 1991 Reforms: In Praise of Creative Destruction

Twenty-five years after the reforms of 1991, India needs more if the country is to escape the Middle Income Trap

Pranjul Bhandari and Rohit Lamba

Pranjul Bhandari and Rohit Lamba

Pranjul Bhandari and Rohit Lamba

|

29 Jun, 2016

Pranjul Bhandari and Rohit Lamba

|

29 Jun, 2016

/wp-content/uploads/2016/06/Inpraise.jpg)

THE WACA, FEBRUARY 1992, Perth, Australia: Sachin Ramesh Tendulkar, 19, punched Craig McDermott off the front foot for a four to reach his third and arguably one of the best Test centuries on the fastest cricket pitch in the world. The rise of a star was being witnessed back home primarily on state-owned Doordarshan. In the November 1993 Hero Cup semi-final against South Africa, India watched the last magical over that Tendulkar bowled exclusively for the first time on a private channel, Star TV. In the years to come, the cricketer’s aggression and confidence on the field, and humility off it, would mirror the aspirations of many for the nation’s economy.

Transitions are never easy, not least in the land of the argumentative Indian. Doordarshan argued in the courts that the ‘uplink of a video signal to a foreign organisation jeopardised national security’. The Star TV network was based in Hong Kong. The case went up to the Supreme Court, which ruled that airwaves were public property, and could be owned or rented by private parties under the watchful eyes of a regulatory authority. The mixed economy model, oft invoked in our middle school Civics textbooks, was mixing a new recipe of ratios.

Through a cautious embrace of economic reforms in the early 1990s (henceforth the ‘Reforms’), of which satellite TV formed a small part, PV Narasimha Rao and his chosen charioteer Dr Manmohan Singh set in motion a new chapter in the idea of India. Perhaps not since the monumental Nehruvian institution building had we seen the emergence of a distinctly new development paradigm that found a lasting impact.

Twenty-five years later, taking stock of the Reforms necessitates a careful analysis of (i) the circumstances that triggered them in the first place, (ii) key decisions of policy that marked an economic shift, (iii) the sociological and political consequences of what followed, and (iv) the lessons that hindsight can now teach us. The said agenda is apt for a few books. So this short essay is a crash course of sorts, providing a framework for those who want to lift the long pen in the near future.

Three key ideas underscore the Reforms—creative destruction, optimal crisis, and the last mile of personality. Austrian economist Joseph Schumpeter put two famous words to the perpetual rise and fall of ideas and institutions: ‘creative destruction’. He described it as a ‘process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.’

India’s old institutional structures were simply not up to the task of taking vast numbers of the poor and middle-class into the 21st century. Restrictions on industry and imports, a stagnant agricultural sector, a surplus but unskilled labour force, capital-starved markets, bloated government debt, and an ever- growing population. Something had to give. Creative destruction was knocking on Raisina Hill’s doors. On 24 July 1991, closing undoubtedly the most iconic Union Budget speech to date, Singh let the Schumpeterian instinct of the Government be known. Quoting Victor Hugo, he said that “no power on earth can stop an idea whose time has come”.

A simple demand for new ideas and institutions isn’t quite enough. To put the theory into practice, at least in a democracy, requires a political and popular buy-in. Such windows of opportunity are gifts of history, to be wasted only at large human cost. Often these windows are framed by a crisis, political or economic. What ‘worldly philosopher’ Albert O Hirschman called an optimal crisis: ‘deep enough to provoke change but not so deep that it wiped out the means to make it’.

In the summer of 1991, India was facing one of its worst economic crises. It was a textbook case: a large fiscal bill meets a ballooning current account deficit with dwindling foreign currency reserves. Global confidence in India’s finances was so low that gold had to be transported from Mumbai to London as collateral to receive aid from the International Monetary Fund (IMF), an event that hit the traditional psyche.

Even with a fertile ground of ideas and an optimal crisis, big change can be dwarfed into ‘measured’ policy responses; sometimes for good reasons and other times because of vested interests. We had been there before—in 1966, in the 1970s, and again during Rajiv Gandhi’s premiership in the 1980s. It took a rather nondescript hero in Narasimha Rao to bring creative destruction and an optimal crisis to rightful fruition.

In a recent biography of Rao, political scientist Vinay Sitapati carefully walks us through the events that lead to the Reforms. For every decision Singh made in North Block, there was Rao and his craftily chosen team at the Prime Minister’s Office in the shadows making tactical political bargains. A man of nine languages, Rao charmed parliamentarians in their mother tongues. Constantly at attack within his party and outside, to pull all of this off with a minority government was a feat that would have done India’s original master strategist Chanakya proud.

The Reforms were a package deal. One lever here, another there, would not have been sufficient. It started with the devaluation of the rupee, a precondition for the IMF loan, restoring export competitiveness. Import tariffs were slashed on a host of goods and services. Foreign direct investment was allowed in. A politically bold reduction of subsidies in certain sectors was initiated; “Budgetary subsidies, with questionable social and economic impact, have been allowed to grow to an alarming extent,” Singh said.

The biggest contribution of the time was almost surely the New Industrial Policy and dismantling of the notorious Licence Raj. The policy delivered four crucial punches: it abolished industrial licensing for most categories; the list of sectors reserved for the public sector was cut; the entry of foreign capital and technology was liberalised; and the archaic Monopolies and Restrictive Trade Practices Act was modernised. In the Growth Diagnostics view of the world—which identifies key constraints—this was it.

The year 1991 was only the start of what one can now regard as a plan set thoughtfully on autopilot. Private banks came up, as did private airlines. Indian capital markets were liberalised with limited entry for foreign institutional investors. Television went from two state-owned channels to 20 private ones. The telecom revolution made its early moves. These were the beginnings of the new regulatory state.

HOW DID THE Reforms change Indian society and polity? This is a big question that many economic historians will debate for years to come. The summer of 1991, followed by the slow but sustained reforms over the next few years, changed the perception of markets and the role of money in daily lives. It gave birth to a new social contract between the state and citizens on the one hand, and among people themselves on the other. A clear societal change that emerged was the reluctant acceptance of the market economy as an idea for the future. The burden of the swadeshi movement, the socialist leanings of the Cold War period, and the heavy influence of leftist intellectuals in the media and policy space had reduced the market to a ‘neoliberal’ system that corrupts society. This began to change. In the modern Indian family’s folklore, parents’ dream careers for their children and the dynamics of the arranged marriage market saw ‘government sector types’ vacate spots for ‘MNC types’.

The Reforms of 1991 gave birth to a new social contract between the state and citizens on the one hand, and among people themselves on the other

The growing lower middle-class began to see the state as a facilitator rather than a dole giver. The private sector offered a new aspirational domain. Entrepreneurship came to be recognised as an instrument of social mobility. Political scientist Devesh Kapur has documented the rise of Dalit entrepreneurs in India. Dalits have typically looked to the state and more recently to political mobilisation as a tool for rectifying cultural wrongs (both approaches have met with some success). Analysing data on a thousand Dalit entrepreneurs, the study brings into focus an entirely new avenue of mobility established and propagated through mechanisms of the new economy.

Politics itself has changed. On the electoral front, the growth of the parallel or ‘black’ economy has amplified the magnitude of money supply during campaigns. From cash handouts to pork- barrel spending, from new age bahubalis (local strongmen) to ever evolving identity calculations, economic growth—while broadly preserving the sanctity of non-violent transitions—has made elections ‘richer’ and more labyrinthine.

At an institutional level, the Reforms successfully pulped the prohibitive Licence Raj. Concomitantly though, the lack of administrative reforms and pressures of coalition politics have led to an even stronger nexus between politicians and corporate entities; entrenched crony capitalism is now the elite narrative. From being the controller, the state has gone on to acquire the role of a liberal gatekeeper with an emphasis on rent seeking.

Arguably, the most significant impact of the Reforms was in the creation of a new social contract between communities. Writes Suketu Mehta, in Maximum City, his epic biography of Mumbai, a city which perhaps captures this contract better than any other, narrating the romantic ordeal of getting on to a local train: ‘And at the moment of contact, they do not know if the hand that is reaching for theirs belongs to a Hindu or Muslim or Christian or Brahmin or untouchable or whether you were born in this city or arrived only this morning… All they know is that you’re trying to get to the city of gold, and that’s enough. Come on board, they say. We’ll adjust.’ Fissures of religion and caste endure. Uneven growth has even contributed to conflict. However, economic interlinks have developed sustainable networks that have aided in preserving civility and harmony in the vast complexity that is India.

The Reforms have raised average and absolute per capita incomes across almost all income percentiles. However, the same cannot be said of the relative standard of living. Income and wealth inequality have either increased over the years, or at best stayed the same. While India may not be an outlier in the time series of the distributional wealth trajectory of nations, the sheer numbers of poor make any inequality metric sombre reading. The Economic Survey of India 2015-16 reports that the income share of the top 1 per cent went from 9 per cent in 1998 to 12.6 per cent in 2012.

Inequality manifests itself doggedly in the agricultural sector, which has undergone a steady decline in growth rates and investment but not as much in the terms of total employment. P Sainath, in his book Everybody Loves a Good Drought, documents poverty in rural India through its myriad complexity in the form of nutrition, infant mortality, literacy, sanitation, irrigation and debt, amongst others.

There are three distinct puzzles associated with the fact that economic liberalisation had a limited or in some cases no impact. First, how is it that despite surplus food and a rapidly growing economy, farmers are killing themselves and children are malnourished? Second, has agriculture suffered because of an excessive focus on economic liberalisation for the elite and pull-back of subsidies by the state, or instead because political interests have denied agriculture and associated supply chains their own liberalisation? And, third, has the Indian state weakened relative to the size of the economy and the needs of the poor, and if yes, why?

Putting on glasses of hindsight is an unfair exercise. However, there are at least two important questions which they can help answer. The first is academic: was 1991 an indispensable causal turning point in the Indian economy? The second is based on a potential counterfactual assessment: given the operational constraints, did the Reforms indeed fulfil expectations?

That 1991 was a big bang reform moment is without doubt, but was it the structural break that changed the course of India’s economy? In an important paper, economists Dani Rodrik and Arvind Subramanian contest this claim. They write, ‘The pick-up in India’s economic growth precedes the 1991 liberalization by a full decade. Even a cursory glance at the growth record reveals that the more-than-doubling of India’s growth rate takes place sometime around 1980, with very little discernible change in trend after 1991.’ The argument is driven by the thesis that the Government in the 1980s dropped the socialism rhetoric and turned pro-business, but not pro-market.

Veteran economist TN Srinivasan has questioned the sustainability of the 1980s’ growth acceleration, arguing it was fuelled by employment and real wage expansion in the public sector, and significant increases in the fiscal deficit and debt. A middle-of- the-road conclusion is easily digestible: the Reforms were not an isolated event, they were built on a history of small steps, but they did provide a well-designed push that put India into a sustainable trajectory of high growth.

Did the Reforms fulfil the task they set out to achieve? Yes and no. They allowed the entry of new firms, and to a large extent democratised the market for entrepreneurs. It is not a coincidence that perhaps the greatest beneficiary of the Reforms was the ‘new sector’ of information technology, now a frontrunner in exports and job creation. India did not go the China or Korea way, from low-tech to high-tech manufacturing, it created its own model of services-driven growth. Even reforms in the banking sector, aviation and telecom were done by stealth. The public sector was not rolled back, but private entry was initiated.

While the Reforms addressed entry, they could not catalyse exit. The Economic Survey of India 2015-16 argues that entry without exit has probably met its limit. In almost every sector of the economy, the lack of exit paths is creating huge economic, political and fiscal costs. Subsidies, such as on fertilisers and kerosene, that cause environmental harm without commensurate social benefits, continue to persist. The blocked exit from bad infrastructure projects has partly swallowed the balance sheets of banks and is holding up private investment. India has a fat tail of inefficient firms which do not exit, and firms with potential do not grow big enough over time.

Another worry is the continued poverty of health and education outcomes. India cannot possibly hope to leapfrog decades of destitution with an unhealthy and untrained labour force. The causality works both ways: greater growth leads to improved health and education, but further growth is not possible without re-investing a substantial portion of the gains in the human capital of future generations.

The unifying theme of the hindsight glasses must certainly be state capacity. The state has to decide where to stay and consolidate, and where to get out. We might be converging to a bizarre situation where the state wants to own an airline and run banks but progressively reduce its role in basic healthcare and primary education.

FILM-WRITER AND lyricist Javed Akhtar once said that “films are not the report of a society, films are the dreams of a society”. As India embarked on liberalisation, its dreams embraced a new yearning, and perhaps no one crystallised that turning point better than Shah Rukh Khan, a Muslim Pathan married to a Hindu Punjabi, a self-made man in the nepotistic world of filmdom. Attached to the on-screen persona of the king-of-romance was a preamble for the middle-class: how to be modern and traditional at the same time, how to strike a bargain between money and values, between the new and old India.

Turning those dreams into reality for all of India requires a booster dose of reforms with a focus on the state’s ability to foster newer markets and administer basic public goods, health and education. Rapid growth tests the capability of institutions to cope with and lay the foundations of a sustainable path. In a recent speech, RBI Governor Raghuram Rajan emphasised the interplay between markets and government for India—a strong market economy must eventually rest on an effective state. India is in the midst of a large demographic dividend, which if not tapped could see this great civilisation staring at the middle-income trap with prolonged human costs. Reforms 2.0 thus need to tackle state capacity. Creative destruction keeps knocking. Can we have an optimal crisis and a 21st century Narasimha Rao to put it to good use?

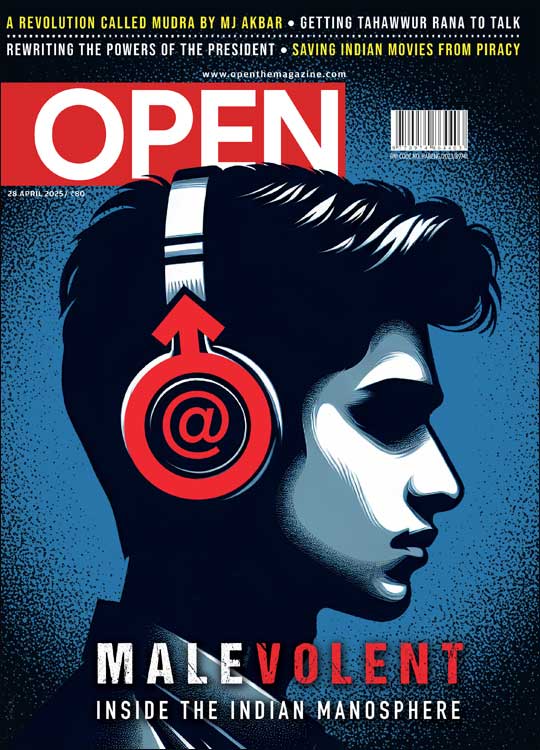

/wp-content/uploads/2025/04/Cover-Manosphere.jpg)

More Columns

Political parties echo anti-Pakistan sentiment after Pahalgam massacre Open

Indus treaty first step as India plans major retaliation Rajeev Deshpande

April 24 - Sachin Day Aditya Iyer