Spent Force

Economic growth will not revive until the Government starts investing instead of handing out subsidies

Dhiraj Nayyar

Dhiraj Nayyar

Dhiraj Nayyar

Dhiraj Nayyar

|

21 Feb, 2014

|

21 Feb, 2014

/wp-content/uploads/2015/11/spentforce1.jpg)

Economic growth will not revive until the Government starts investing instead of handing out subsidies

‘Neither the government nor the economy can live beyond its means year after year.’ Finance Minister Manmohan Singh said that in his historic Budget of 1991, when he began to unshackle India’s economy from the worst excesses of State overreach. It’s ironic then that the wheel has come full circle under Prime Minister Manmohan Singh. The UPA has lived beyond its means. It is now left to the next Finance Minister to do an encore a la 1991.

To be fair, Finance Minister P Chidambaram took extraordinary pain in his Interim Budget speech to pin the fiscal deficit for 2013-14 at 4.6 per cent of GDP, lower than his target of 4.8 per cent. He slashed expenditure. He even juggled statistics. After all, he had to persuade creditors, investors and global rating agencies that the Government of India, despite its previous profligacy, was now committed to prudent spending.

There are serious consequences for the economy when the Government spends beyond its means. In doing so, it takes away financial resources—through its borrowings—that would otherwise have been available to the private sector. When the Centre borrows big sums of money, interest rates are driven up, making loans more expensive for private borrowers. And for the aam aadmi, overspending fuels inflation, either because the Government is pumping money into the demand-side of the economy which supply cannot match, or because it is printing extra money to finance itself faster than extra goods and services can be produced and delivered. Often, the Centre allows inflation to fester so that its own debt burden is lightened. Remember, inflation is good for debtors—since every repaid rupee is worth less—and bad for creditors. Whichever way, a wide fiscal deficit weakens the economy’s fundamentals and deters investment, so crucial for economic growth.

But there are ways and ways of slashing the fiscal deficit, just as there are ways and ways of spending money. Beyond the headline deficit figure, which attracts the most attention, the manner in which the deficit is cut and how the Government spends also has crucial implications for the economy’s future. One type of spending is known as Plan expenditure, which is largely money spent on productive projects—infrastructure, for example. This yields returns and helps the Centre raise revenues. And there is a second type, non-Plan expenditure, which is the consumption spending of the Govern- ment largely on subsidies, salaries, pensions and interest payments. This type yields no return and pushes the State to live beyond its means.

v What the UPA has done is perverse. It has cut productive expenditure while continuing to spend unproductively. No matter what Chidambaram says, the Government of India is still living beyond its means. Solving this problem will now be the next Finance Minister’s headache. Consider this. For 2013-14, Chidambaram slashed Plan expenditure by almost Rs 80,000 crore, a 14.4 per cent cut on the estimate he presented in his budget last year. Non-Plan expenditure has actually turned out Rs 5,000 crore in excess of last year’s estimate. And this does not include the Rs 35,000 crore in fuel subsidies that he pushed to the next financial year in a sleight of hand. He had to; he would not have attained his deficit target without doing that.

This is not Chidambaram’s choice alone. The Congress-led UPA has decided that there is no way it is going to cut non- Plan expenditure. If the deficit has to be reined in, it must be done through cuts in government investment. The UPA Government had opportunities to signal its seriousness on curbing unproductive expenditure. On the credit side, it tried to deregulate diesel prices with some success. On the debit side, it failed to reduce LPG subsidies and was forced by Congress Vice-President Rahul Gandhi to actually raise that subsidy weeks before the Interim Budget. It went ahead with the populist announcement of a pay commission for bureaucrats without any commitment to downsize the bloated government. Last year, it announced an expensive food security bill, which hasn’t been rolled out yet and has thus spared Chidambaram the blushes of allocating even more non-Plan expenditure to it. For the Congress, subsidies are indispensable, even if they are indiscriminate— how else can you describe an LPG subsidy for the middle-class and rich, a diesel subsidy for SUV owners and cheap wheat and rice for 67 per cent of the population?

They form the basis of the party’s political economy framework. If expenditure cuts need to be made, they can be made on roads, power, education and health, precisely the sectors that would yield returns in the future, not just for individuals but for the country as a whole. They would, in fact, enhance the economy’s growth. Yet, Chidambaram’s allocations for some of these important sectors have been ruthlessly reduced for the next financial year—figures that can of course be altered by the next Government in July—to gain credibility for his fiscal deficit target of 4.1 per cent.

The only other way to finance the UPA’s Subsidy Raj would be to raise taxes. That would have been imprudent before a general election, as voters already angry with the UPA for its failure to curb inflation and clamp down on corruption would be furious. In the end, Chidambaram cut excise duties to appease the tax-paying classes. His numbers may not add up for next year—he is assuming an 18 per cent growth in tax revenues, higher than the 2013-14 target he could not achieve—but he is unlikely to be the Finance Minister who must rework the arithmetic. The Congress will almost certainly not return to form a UPA-3.

It will be the task of the next Government to consolidate India’s fiscal position. The NDA Government had passed a Fiscal Responsibility and Budget Management Bill in 2003, but the UPA violated it with abandon after 2008. A new dispensation will have to lay out a credible path towards the goals envisioned by that Act. This would mean reducing the fiscal deficit to no more than 3 per cent of GDP, ideally in three years. Perhaps more importantly, it needs to commit itself to a near-zero revenue deficit—so that no borrowing happens for unproductive expenditure—by the end of its term. If the revenue deficit is close to zero, the Government can run a reasonable fiscal deficit (up to 3 per cent) so long as that extra spending is invested in roads, ports, irrigation, education and health.

For that to happen, the next Government needs to take a collective call on fertiliser, fuel and food subsidies. It is impossible to abolish all subsidies in a country where a quarter of the population still lives below the poverty line, but it’s certainly possible to curtail them significantly. There is no case at all for subsidies on diesel and LPG to continue. A system must be devised to aim all special benefits at the country’s poorest (with the aid of direct cash transfers), while petroleum products are retailed at market prices. The Food Security Act needs to be reexamined and amended at the very least. Two-thirds of the country does not need coverage. At the same time, there must be a renewed emphasis on implementation; a leaky Public Distribution System is simply money wasted. Even fertiliser subsidies can be rationalised. Over-subsidisation just enriches fertiliser producers and incentivises the indiscriminate use of these products, which damages the soil.

Such decisions cannot be taken by a finance minister alone. They need wider political support—of the Cabinet, coalition partners and the people at large. It’s a pity that no political party talks explicitly about curbing expenditure on subsidies to invest that money in building infrastructure and generating jobs. Subsidies never generate jobs. They never make anyone genuinely prosperous. The people of India, even the poor, must demand much more than subsistence.

The next Government could also help itself by reforming India’s archaic tax structures. That would generate more revenue, which could help the phase-out of subsidies and greater investment in productive assets. The Goods & Services Tax, which the UPA failed to forge a consensus on, should be on top of the next Government’s agenda, along with a revision of the Direct Taxes Code so that rates are lowered, the tax base widened (by ending exemptions—even on agricultural income) and compliance enhanced.

Of course, the case for increasing expenditure on productive assets must be linked to positive outcomes. There is no point in pumping money into highways that are half-built, schools with no teachers, or hospitals without doctors. The UPA promised much on ‘outlays and outcomes’ but delivered little on the latter. Public-private partnerships, the one way to get things done using Government money and private efficiency, have degenerated into a morass of crony capitalism. Again, the Centre needs to take a call. Will it go back to financing and executing projects on its own? Or can it re-inject credibility into a ‘State financed-privately delivered’ model? China has used the latter extensively and very successfully. India needs to do the same but with a much greater emphasis on transparency than has been the case so far.

The real economic debate in India ought not to be whether the Government has a role in economic development or not. It does. The real question is how it must play this role. Without going into the somewhat pointless binaries of Left and Right, it is amply clear that one school of thought believes that providing subsidies and spending on welfare are the primary role of the State. It is not clear if there is an alternative that doesn’t believe in subsidies and welfare spending. No political party speaks openly against that for fear of being labelled ‘anti-poor’. However, there is plenty of intellectual support for a government that spends minimally on consumption but significantly on investment. India needs both private and public investment to expand its economy by double digits year upon year, and needs to sustain such growth for three decades before it can lift its people out of poverty and assure them a reasonable standard of living.

The economic reforms of the early 1990s and early 2000s did not resolve that debate. Each time the Government overextends itself, its simple response is to cut Plan expenditure while letting subsidies and other spending—particularly on the salaries and pensions of a bloated bureaucracy—run haywire. India needs its Government to contribute to enhancing its prosperity. This demands investment. There can be no second-generation reforms if the Government insists on spending money unproductively. If it carries on this way, history will only repeat itself—as crisis.

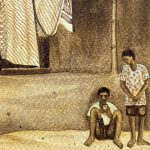

/wp-content/uploads/2025/08/Cover_Blueprint.jpg)

More Columns

How Cubism Became Vernacular in India Shaikh Ayaz

This Alternate Asia Cup XI Will Give Team India A Run For Its Money Short Post

Graphic Narratives that Tell Magical and Relevant Stories Rush Mukherjee