How We Buy

Why we savour as much as monitor our family experience at large-format outlets. And why we are not ready to dump our cornerstore kiranawala

Ranjan Banerjee

Ranjan Banerjee

Ranjan Banerjee

|

18 Mar, 2012

Ranjan Banerjee

|

18 Mar, 2012

/wp-content/uploads/2015/11/consumer-2.jpg)

Why we savour as much as monitor our family experience at large-format outlets. And why we are not ready to dump our cornerstore kiranawala

Does the following scenario ring a bell? It is a weekend afternoon and you are contemplating a family excursion for the evening. It is a joint decision for a young, nuclear family, and you, your significant other and your little ones all have to reach a consensus. You consider and reject many interesting options: an amusement park (too far); a movie show (you cannot agree on a movie); the national park (long queues/too late). Your deliberations have taken too much time and you are left with the urban family’s predominant weekend pastime: a trip to the nearby mall.

This familiar and slightly depressing anecdote illustrates a pertinent fact when it comes to the urban Indian shopper: a visit to a mall/hypermarket/shopping centre is often also a family excursion. Any reflection on our behaviour as shoppers has to be grounded in an understanding of the objectives and expectations that we as shoppers have when we visit a particular shopping environment. This, in turn, suggests a need to first profile and understand the shopper himself, for it is well understood that ‘why and how we buy’ is often a reflection of ‘who we are’.

The late CK Prahalad once commented (in a consumer behaviour context) that ‘there is no single India’. I endorse this truth, and restrict myself to what Kishore Biyani calls ‘India One’, India’s consuming class, which has high disposable income, access and exposure to Western lifestyles, and constitutes about 10 per cent (1) of the population. I focus on this class because of the paucity of space, my own comfort and awareness, and the readership profile of Open.

We cannot explore the shopping behaviour of India One without exploring the nature of India One. In doing so, I recognise that there will be many generalisations, for the differences within India One are many, whether it be factors of geography, language, family structure or exposure. However, I will stick my neck out and say that a majority of India One has had a conservative middle-class upbringing with a focus on good values, hard work and education as a key to progress and success. Consequently, factors that describe a representative India One bread earner include the following:

» He is younger than his counterpart in Western countries. He has often achieved prosperity before the age of 40, and has thus attained success at an age where his need for consumption of products and services is broadbased. (This is in contrast to developed markets, where, to quote Paco Underhill, over two-thirds of discretionary income is in the control of people over 50.)

» He is part of two strongly interlinked family environments: his own nuclear family, with children who have been part of a post-Liberalisation environment; and an extended joint family, where he stays with or shares significant aspects of his life with his parents. These twin generations—a young generation, which lays emphasis on technology and individualism, and an older, supportive generation, which cautions against the excesses of consumerism—provide the balance of consumerism and thrift, aspiration and conservatism, at the heart of Indian shopping attitudes.

» He values, and seeks to retain, many aspects of his own upbringing in the environment his children grow into. He wants his children to imbibe the value of hard work, and be capable of competing in what he considers a ‘cut-throat’ environment. Education and bonding with a larger extended family are positive associations.

Simultaneously, a lot of choice is now available to him. Foreign travel is now an option (on business or pleasure), and brands that were aspirational but inaccessible to him as a child are now available at the friendly neighbourhood mall. While he is wary of ‘spoiling the kids silly’, he likes the idea of an international lifestyle at home, and is, in many ways, happy that his kids have so much more choice on multiple fronts.

An area of dissatisfaction for him is time. He does not spend as much time with his family as he would like. Both he and his wife often feel perpetually busy, and the need for leisure, more attention to health and ‘work-life balance’ are perpetual themes in living room conversations.

The shopping habits of this consumer are a reflection of the hybrid environment he lives in. He values the traditional and modern, and this is reflected in the way he shops. There has historically been a lot of debate on the impact that super/hypermarkets will have on traditional Indian retail, but the evidence so far suggests that they will co-exist and thrive together. There are many reasons for this, but the nub is that even for the well-to-do urban consumer who does not find hypermarket environments intimidating, the objectives and expectations from modern and traditional retail are different, and these differences are manifested in patronage and purchase.

India One shops at a super/hypermarket at least once a month. This is often a family excursion, and the shopping trip is combined with eating out or some other form of recreation. Typically, the lady of the house has decided the list (written up in about half the cases), the husband (with some assistance from kids) is the cart pusher. The family has brands in mind, but often likes to consider one or two brands based on what is available in the store. The kids have a designated role: they are either consultants on specific categories, or given one or two items they can pick for themselves (frequently, they exceed their brief).

The hypermarket is frequented for: the convenience of multiple brands/categories under one roof, the ambience and cleanliness of the environment, and the pleasure of choice and discovery. Retail stores also offer their own discounts and special offers, and ‘bargain hunting’ is in the DNA even of the most well-to-do Indian family. There is also an element of shopping enjoyment, and impulse purchases imply that families often confess that they ‘spend more than they had expected’ at the supermarket.

India One uses modern trade for branded and packaged foods, toiletries, books and music, and packaged frozen meat items. Branded apparel and electronic durables are other categories for which the convenience, choice and experience offered by the large departmental store are preferred. However, for reasons that I shall come to later, when it comes to fresh fruits and vegetables, and even many staples, the supermarket is often not the retail format of universal preference.

An interesting sidelight here is that India One’s behaviour in a retail environment is generally more formal than in a kirana store. It is not just that the family comes dressed to the store. The language of conversation (as per proficiency) is English or Hindi. The storeperson is treated more like an equal. In such ways, the consumer adapts his behaviour to the environment of the store.

What of traditional retail? There are many reasons for its survival. Consider demand: research across countries shows that consumers choose, for frequent patronage, stores that can be accessed within 15 minutes. The intensity of penetration of the kirana store and local vendor, coupled with the shortage of large retail spaces, implies that this convenience is often better provided by the friendly neighbourhood retailer. Further, kirana stores have been prompt in adapting to competition. They have responded with quick and flexible home delivery services, enhanced store display and proactive initiation of credit facilities for new customers.

The kirana store is a far more informal shopping environment, and use of the local language in consumer interactions is common. The relationship element is stronger, and regular patrons are recognised by name. In this environment, the distinction between shopping and buying is blurred, with customers ordering by brand pack and storeowners making suggestions that are customised to their past references.

For fruits and vegetables and other perishables, customers often have an identified local retailer from whom they buy regularly. They like to know that the vendor gets daily supplies, touch and feel the merchandise themselves, and rely predominantly on one vendor, secure in the knowledge that the regularity of purchase implies that the vendor has a lot to lose by offering inferior quality. Another advantage of buying from the local vendor is that bargaining is seen as an integral part of the shopping experience, and the inability to bargain is cited by consumers as a drawback of modern retail outlets.

In essence, my point is simply this. While there are strong supply and demand related factors for India One’s patronage of traditional and modern retail formats, there is a strong cultural aspect as well. Today’s young adults are a hybrid generation. Their parental culture stresses conservatism and ‘smartness’ in terms of effort undertaken to identify a bargain. It is not uncommon for somebody to purchase an item of food or clothing, and then ask family to guess the price. Shopping expertise is manifested in the ability to derive both quality and price, and a part of the utility that the individual shopper gets is from his demonstrated ability to get a deal. This expertise is muted by the modern supermarket, and keeps patronage to the bazaar and local retailer alive.

There are, of course, exceptions like the Future Group, which identified and catered to these needs early. It was no accident that the earliest launches included Big ‘Bazaar’ and Food ‘Bazaar’. The idea was to replicate the feel of the bazaar. Aisles were not narrow and rectangular, but merchandise was in clusters. The stores were created as clusters of mini-bazaars where customers can roam freely. This gives the store a crowded and even untidy feel, which may disappoint some Westernised observers, but serves its purpose: to provide a smooth point of entry into modern retail for the bargain-conscious customer who is upgrading to the top tier. This customer likes the feel of the bazaar, but is uncomfortable with ultra sanitised, expense-exuding retail environments. The discomfort is both in terms of a disconnect with one’s historical notion of a pleasant shopping experience, and with the unstated perception that ambience costs are reflected in higher prices!

Conversely, their Westernised self (and their ‘generation next’) desires the Western lifestyle and luxuries that were inaccessible earlier. This need is catered to admirably by modern formats. Perhaps we still have some way to go in terms of amenities, in-store signage and merchandising, but this is likely to improve. However, the hybrid nature of the Indian shopper and reluctance of the lower middle-class to patronise ‘non bazaar’ outlets, combined with high real-estate costs, suggest that the profitability of many formats will continue to be a challenge.

Supermarkets are visited infrequently, and since many of these visits are not specifically for a shopping mission, the baskets are also smaller. Further, the service provided by the local retailer, in combination with space constraints at home, suggests that the ability of retailers to pass inventory-holding costs on to the household is severely limited in comparison with Western markets.

What developments can we anticipate in our shopping environments? One area that holds great promise is the emerging field of behavioural economics, which combines insights from economics and psychology to shed light on how the consumer makes decisions. A central insight is that we hate losing more than we like to win: the need to avoid a loss of one rupee is stronger than the desire to gain a rupee, and this could guide the use of superior customer information for modern retail to make significant gains by dangling customised offers at the point of sale. This strand of research also suggests that we do not make decisions in absolute terms, but in relation to a reference point. A sharper understanding of the Indian shopper’s implicit reference points could help us design shopping environments that are not mere clones of Western formats, but are tailored to his specific needs. Finally, we need to design formats that are tailored to both the supply and demand considerations of an emerging India. (I did think Subhiksha had an interesting model, and its failure does not mean that the attempt to construct an original Indian model was misplaced). Another retail business opportunity relates to the urban family’s need for recreation and leisure. The entire field of ‘retailing vacations’ is waiting to open up, and much can be done here to offer innovatively mixed and matched experiences.

Also of relevance to the future of shopping is the institutional environment. Simply put, a consumer in a developed market makes online purchases with less fear because the option of legal redress safeguards him from cheats. In India, we do not consider the law a serious deterrent to unethical behaviour by a retailer. In theoretical terms, we replace the legal safeguard with the relationship safeguard: ‘He won’t cheat me because I buy regularly from him.’ As the institutional framework in India improves, this implies that consumers would be more open to such ‘faceless’ channels as e-commerce.

India One will soon pose both traditional and modern retailers an interesting challenge. The next generation of India One, the Facebook generation, would have grown up in the post-Liberalisation era—with a high degree of technology comfort and openness to different modes of shopping. They have new ways of accessing and receiving information, and could thus redefine all that we currently know about shopping behaviour in India. But then, that’s another story…

Dr Banerjee can be reached at research.ranjan@gmail.com

1. Throughout this article, I do not cite specific numbers or percentages for simplicity. I have drawn from published research from McKinsey and NCAER, published research by retail scholars, notably Professor Piyush Sinha, and colleagues at IIM-Ahmedabad, as also my own firm’s qualitative research

About The Author

CURRENT ISSUE

MOst Popular

3

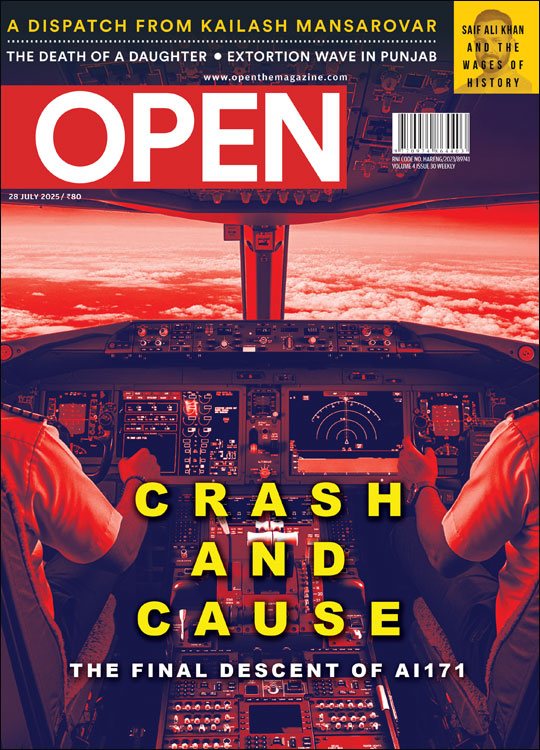

/wp-content/uploads/2025/07/Cover_Crashcause.jpg)

More Columns

Bihar: On the Road to Progress Open Avenues

The Bihar Model: Balancing Governance, Growth and Inclusion Open Avenues

Caution: Contents May Be Delicious V Shoba