Populists in the Marketplace

WE CAN LIVE in a state of denial. Or in a state of wishful thinking. Or in the state of reality. This is the age of populism, globally. It has already changed politics; it is altering societies; and rewriting conventional economics. What is happening now could determine the global economic trend for the next three decades. It matters. Therefore, it must be properly understood and not dismissed merely as a short-term blip.

An economy moves in cycles from boom to bust to boom. Periods of high growth and periods of low growth/recession crisscross a long-term growth line, which depicts the 'smoothened out', non-cyclical trajectory of progress (or in rare cases, regress). Ideas in the field of economics/economic policy have moved in a similarly cyclical fashion in the last 100 years. Communism was an aberration. The dominant idea for the last 150 years has been capitalism. The last 100 years have also been the period of greatest prosperity in human history. But the precise form in which it has been practised has gone through cycles—from infant industry protection in the early 19th century to an emphasis on unfettered free markets and globalisation at the turn of the 20th century which was followed by a shift towards a welfare state, regulated and de-globalised economy in the 1940s, lurching again to deregulation and globalisation in the 1980s and now to an emphasis on nationalism, welfarism and de-globalisation since the mid-2010s. Despite all the cycles and shifts in the dominance of ideas, the last 100 years have been the period of the greatest prosperity in the history of mankind. Economist Bill Easterly has calculated global GDP over the last 500 years—normalised and adjusted for time of course—and found that global GDP was virtually flat (not even $1 trilion) for the 400 years between the early 16th century and late 19th century after which it has grown from under $5 trillion to over $80 trillion in the last 100 years.

That said, the pendulum of ideas seems to swing, every three or four decades. Significantly, the big shifts in ideas in capitalism have originated in the Anglo-Saxon world, the US and the UK, which were not only the first to signal a change domestically but were also able to export their influence to other parts of the world.

In many ways each economic cycle lays the seed for its own demise. Karl Marx believed that this destructionist tendency would destroy capitalism. But it has not, because even as failure is imminent, the realm of ideas combined with politics offers an alternative which denies the naysayers.

AIming High

20 Feb 2026 - Vol 04 | Issue 59

India joins the Artificial Intelligence revolution with gusto

Populism can be quite dexterous. It can sit as easily on the Left as the Right. Broadly, it involves a rebellion against the incumbent elites and strong appeal to the ordinary, average person. In the last century, it sat quite comfortably with socialism and its variations, whether in the communist revolutions in Russia and China or in the national socialism of Germany and Italy or in newly independent countries in Asia, Africa and Latin America where it combined with nationalism. The failure of those socialisms—moral, political, social and economic—left populism looking for a political home. Somewhat ironically, given its previous history, it has housed itself in the most capitalist countries in the world, the US and the UK. This time, the rebellion is not against capitalism per se—perhaps there is not sufficient appetite for a move to discredited left -wing economics—but it is against the manner in which capitalism has played out in the three-and-a-half decades of globalisation with all its side effects.

Remarkably, it played out quite well actually, for large parts of the world, at least until the late 2000s. In the US and the UK, there were long periods of growth without slipping into recession. It prompted the then Chancellor of the Exchequer of the UK, Gordon Brown, to proclaim that New Labour had ended the cycles of boom and bust for good. In the US, Chairman of the Federal Reserve Alan Greenspan (who was in office between 1986 and 2007), a known free-marketer, won much praise for his stewardship of the world's largest economy. Much of Eastern Europe, which had spent five decades under communist isolation integrated quite well with the west of the Continent and, with the exception of an initial period of shocks in the early 1990s, Eastern Europe achieved much higher levels of well-being. Two of the largest and poorest countries in the world, China and India, pulled an unprecedented number of people—possibly a billion put together—out of poverty. In 1980, China's per capita income was under $200. In 2015, it was over $8,000. India's GDP per capita rose from just over $200 to around $2,000 over the same period, not as impressive as China's but a 10X increase nevertheless. At one level, it would have seemed that an embrace of free markets and globalisation benefited both the developed and the developing countries of the world. Latin America and Africa went through a difficult period in the 1980s, with tough adjustments required to make up for the profligacy of an earlier period, but by the 2000s, these regions were also growing faster than before.

For the world, at a macro level, was there a greater period of overall prosperity than the two-and-a-half decades between 1980 and 2005?

There is a difference between macro and micro. There is a difference between trends at a national level and trends at the level of individual citizens. The benefits are unequal. There are winners and losers.

In the US and the UK, the biggest winners were in the world of finance. Wall Street and the City of London prospered like never before. Of course, it would be patently false to claim that the globalisation and evolution of finance only benefited bankers. The abundance of affordable capital enabled investment to flow into emerging economies lifting their GDPs and helping poverty alleviation. The availability of cheap finance coupled with complex products enabled millions of lower-income groups in countries like the US and the UK to be able to buy homes through very low interest rates. A problem began to emerge when financiers edged towards taking greater and unmanageable risks—bundling subprime assets to create a top-rated asset with the help of supplicant credit-rating agencies was always a time bomb waiting to explode. Regulators were either asleep at the wheel, or not nimble enough to figure out what was going on or perhaps just didn't want to be the party poopers. In the end, or what can now be termed as the beginning of the end of the most recent era of globalisation, the collapse of a large investment bank, Lehman Brothers, on September 15th, 2008, was the explosion that had been imminent for several months.

The management of the aftermath is equally responsible for the rise of populism. At a macro level, it is feasible to argue that policymakers in the US and the UK and indeed in emerging economies like India responded well. The world did not slip into a dramatic depression as in the 1930s. The epicentre of the crisis lay in banks. Banks are the heart of the economy: if they stop working, the entire body economic could die. Therefore, banks had to be bailed out, rescued from failure. And they were, with some being temporarily nationalised in the advanced economies. At the same time, in a lesson taught by John Maynard Keynes after the Great Depression, expansionary fiscal policy was used as a counter-cyclical measure against the slowdown.

Again, there was a difference between macro and micro. Banks got a bailout but not homeowners who lost their houses in foreclosures. Banks returned to business as usual within a handful of years with all their previous 'vices' including risk-taking and exorbitant salaries. Once growth had recovered—or recession stalled—fiscal austerity became the prevalent mantra. The cutbacks disproportionately affected the lower and middle income groups which are larger in number than the upper-income groups, a minority. In some parts of Europe, where economies had fundamental structural weaknesses, the fiscal expansion ended in a sovereign debt crisis forcing an even stronger form of austerity. Unsurprisingly, while the incumbent governing elites of the world patted themselves on the back for averting a Great Depression, the ordinary people of the world viewed the exercise as a partisan bailing out of other elites (the financial elite most notably) at the expense of the ordinary citizen, creating fertile ground for a populist upsurge.

However, the global financial crisis and its aftermath were not the only reasons for the rise in populism. The globalisation of finance was accompanied by a globalisation of trade. The two-and-a-half decades starting in the 1980s saw an ambitious dismantling of trade barriers. The Uruguay Round of multilateral negotiations which ran through the 1980s and culminated with the creation of the World Trade Organization in the 1990s heralded the most open regime for global trade. China's entry into the WTO at the turn of the millennium completed the circle. The same period also saw the formation of big regional free trade agreements like the North American Free Trade Agreement, the expansion of the European Union after the fall of communism, the Association of Southeast Asian Nations and the Mercado Común del Sur (Mercosur). Sceptics argued that free trade would benefit advanced economies at the expense of emerging economies. Ultimately, it led to a rapid deindustrialisation (of the old, conventional manufacturing) in the advanced economies and an impressive industrialisation in those emerging economies which had their domestic house in order—most notably China but also elsewhere in East Asia, parts of South Asia and some parts of Latin America. Consumers in the advanced economies got access to cheaper products but workers who had spent long years in manufacturing suddenly lost their jobs and livelihood.

The period beginning in the 1980s also saw the onset of the third industrial revolution which began with personal computers, gathered pace with the internet in the 1990s and brought cutting-edge technology to the production processes added to the woes of the 'working class' in advanced countries. It was not just China taking away their jobs—it was machines as well. Even services were vulnerable with countries led by India becoming the IT services hub of the world. Politicians in the West made periodic noises about unfair competition from China and getting 'Bangalored' but they did not take much action, leaving the political field open for someone to challenge the global economic order which had emerged.

You would expect that a backlash against free trade and globalised finance would come from the Left of the political spectrum given that ideology's suspicion of free markets. Instead, it has come from the Right. One reason for that may be that the mainstream Left in many advanced countries had moved to the centre or even centre-right (think New Labour in the UK or the US Democrats under Bill Clinton and Barack Obama). There are other reasons.

THE RISE OF radical Islam, most spectacularly with 9/11 but with several high-profile terrorist incidents in the West—many orchestrated by immigrants to those countries—provoked a more general backlash against the movement of people across borders. The globalisation of labour never came close to the globalisation of finance and trade, but a sense of insecurity, driven by both terrorism and economic loss laid the foundations for parties of the Right and Far-Right to capitalise. In the UK and Europe, large scale immigration from the Eastern European countries which became integrated with the EU caused its own backlash behind fears that these immigrants would take jobs away from locals.

There is yet another reason for the rise of populism on the Right, not the Left. Throughout this period, people were becoming distrustful of ruling elites and governments—for their cosy relationship with business, for inequality and for bargaining away the national interest to other countries. The populist Left was there to offer more government, a bigger state. But the distrust of the ordinary person was as much against the faceless forces of globalised finance and trade as against the very well-known faces of the incumbent political elites and the governments they represented. This was not a moment ripe for a big state revolution.

It is the distrust factor which also explains the rise of populists in the emerging economies. From Brazil to China to India, the period of rapid growth—admittedly the positive outcome of globalisaton—also led to rampant cronyism and corruption. In these partially liberalised economies, the state had not withdrawn from the economy. It still retained large amounts of discretion. A rapidly growing economy which was attracting investor interest from abroad and within was also a perfect opportunity to collect rents. In the open societies and political democracies of India and Brazil, cronyism and corruption became the dominant public narrative in the second decade of the millennium. Even in China, where the public narrative is tightly controlled, stories of corruption and scandal began to emerge which led to the top echelons.

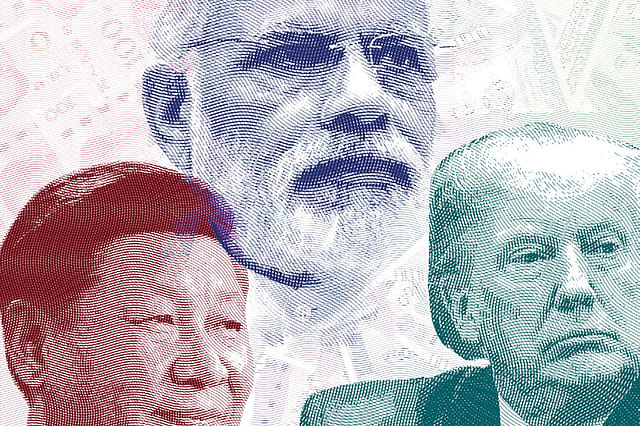

Again, the Left of the political spectrum was not looked upon favourably because governments were viewed as part of the problem, not part of the solution. The road had been paved for the rise of populists from the Right of the political spectrum including India's Narendra Modi, China's Xi Jinping and Brazil's Jair Bolsonaro, all moulded in a strongman cast, who pledged to take strong action against corruption and cronyism and remove from power the old elites who had unfairly or illegitimately benefitted from the old order. The outcomes from the earlier period of boom were seen to have accrued to a small minority whereas the majority had been left behind.

It is not surprising, therefore, that many populists on the Right practise a mix of market and apparently anti-market practices. The underlying message is that policy will be made in the national interest (as opposed to the international interest in the era of globalisation). The purpose is to try and ensure that any policy impacts positively the maximum number of ordinary citizens. There is an emphasis on strong, determined decision-making.

Policy formulation in the populist framework often defies conventional distinctions between Left and Right: Trump has implemented tax cuts for corporates while imposing tariffs on imports; Boris Johnson wants to limit immigration and invest heavily in a government health service; Modi is creating a positive environment for business by cutting regulation and taxes and focusing on welfare programmes for the poor.

THE SUCCESS OR failure of these leaders and their populism, and its lasting power, depends on how well they respond to the expectations of the majority. Some of them have begun by taking 'tough' economic measures which according to conventional economic thinking are highly retrograde. Trump has responded to those who lost their jobs in the American Midwest by engaging in a trade war with China. He has also made immigration policies stringent. Johnson has responded to his constituency by promising and likely implementing a quick Brexit with or without a deal with the EU. Modi invested his political capital in demonetisation, GST and the bankruptcy law in a bid to convince voters that he was deadly serious about clamping down on corruption, cronyism and the old elite associated with those traits. Some success, in political terms, is already apparent. Modi won a second term with an increased majority, Johnson just won a landslide weeks ago and Xi engineered an unprecedented third term as China's leader.

Over the medium term, policy measures will have to be judged against outcomes. A fall in global trade, a clampdown on immigration and tough domestic measures may diminish growth prospects. The future for large economies with large domestic markets, like the US, India and Brazil, may be better than for smaller economies which depend almost wholly on their linkages with the outside world. In the US, growth is robust and unemployment at a historic low despite Trump's trade and immigration measures. China and India have slowed down from the previous epoch but remain the fastest growing major economies in the world. India, in particular, has a young population which could power strong growth even without favourable global conditions.

The onset of the fourth industrial revolution may work as a good complement to the new, less globalised order. With the arrival of new technologies, particularly in manufacturing (3-D manufacturing to take one example), we may yet see a return to a more localised economy from a much globalised one. However, it is too early to say when exactly this will happen as many such technologies have not been commercialised or are not yet commercially viable.

It is always difficult to predict the future. Economists are notoriously poor forecasters. It is highly unlikely that the current cycle of populism will lead the world, and its economies, to doomsday. Needless to say, it will generate plenty of challenges, not just economic but also social and political. There will be winners and losers, a different set from the last cycle. If the history of the last 100 years is a guide this cycle too will end. But the market economy would survive and the world will continue to become more prosperous.