Boom to Bust Acquisitions

India Inc forked out close to $40 billion over the last three years buying large companies overseas. But its grand global coming out party has left it with a bad recession hangover

/wp-content/uploads/2015/11/business-boom2bust.jpg)

India Inc forked out close to $40bn over the past three years buying companies overseas. But its global coming-out party has left it with a bad recession hangover

India Inc forked out close to $40bn over the past three years buying companies overseas. But its global coming-out party has left it with a bad recession hangover

Ratan Tata tends to sound unflappable at the worst of times. So when he sent out a worriedly worded internal mail to all Tata company CEOs a few months ago, a hush descended on Bombay House, the group’s headquarters in Fort, Mumbai. He had everyone’s attention. Any failure to manage the implications of the global financial crisis, he warned, could result in “irretrievable” positions. “Some of our companies with substantial foreign operations, or those which have made substantial acquisitions, are already facing major problems in raising capital or establishing lines of credit for their operations,” wrote the Tata Group chairman.

In referring to the group’s troubles in the global mergers & acquisitions (M&A) arena, he was stating the obvious. The mood at Bombay House had been sombre for months together already, in marked contrast to the ebullience that had gripped the otherwise conservative business group less than a year earlier.

It was in 2006, really, that India Inc’s takeover fever began, with London-based Mittal Steel’s bold move to snap up Arcelor, a prestigious European steelmaker. The charge from domestic shores was led by the Tata Group, with Ratan Tata himself formulating an aggressive global acquisition strategy that would involve loan-funded cash deals rather than seemingly simpler stock swaps. The idea, ironically, was not to be vulnerable to any boom-and-bust cycle. In this, Tata had the confidence of his experience with Tetley, a UK-based tea company bought by Tata Tea in 2000, and a subsequent coffee deal as well.

By late 2006, the Bombay House plan for Tata Steel’s global expansion was ready for action. From being a potential takeover target in an industry where consolidation was the name of the game, the steelmaker struck out audaciously to buy a company more than five times its size, UK-based Corus, for $12.2 billion.

It was 2007, and the Indian economy was in boom, with business confidence soaring. Emboldened, Tata Motors acquired Jaguar Land Rover (JLR), the unit that makes these British car marques, for close to $2.3 billion. The dream roll had barely begun, though, that the global business environment darkened.

DESERTED ROAD

Today, corporate values are so low that the money spent on buying JLR could buy Tata a big chunk of JLR’s erstwhile parent, Ford. Even at the time of purchase, many questioned the logic of an Indian manufacturer of trucks, boxy diesel cars and the ‘promised car’ (now Nano) trying to make a go of marketing ultra-luxury brands such as Jaguar across the world. Well, the sceptics are now out with even greater ammunition. The global automobile industry is skidding perilously off its profit path, a global recession brought on by the financial sector blowout is knocking the stuffing out of sales, and JLR finds itself heavily dependent on a bailout package from the UK government. Secured at the threat of axing jobs at JLR’s British plants, £27 million has been extended as a loan by the UK government (to develop ‘green technology’), while £280 million has come from European Investment Bank (for ‘low emission cars’). JLR is lobbying hard for a further £500 million from a kitty of £2.3 billion earmarked by the UK government to bail the country’s auto industry out.

After a round of voluntary retirement schemes, a two-year pay freeze, and cash injection of £400 million, JLR could still be short of working capital to keep those spiffy Jaguars rolling off its assembly lines. This luxury car still holds appeal amongst a global elite of motorists who think of their wheels as a mode of self expression, but Land Rover, critics say, is likely to prove a stiff challenge. Nobody in recent memory has made money from its all-terrain vehicles, though Tata Motors could well use its 4×4 SUV technology to beef up its own vehicles and make a mark in other tropical markets that may welcome an exotic new range of diesel-driven deliverers of top-class torque. But all this is far off. For now, it’s a crisis.

IRREVERSIBLE EXUBERANCE

Tata’s troubles are emblematic of the problems facing many of India Inc’s bravest M&A adventurers. Most of them embarked on a global shopping spree in the midst of the heady boom years of the not-so-distant past without much of a contingency plan, as it appears. A report by the consultancy firm Watson & Wyatt, points out that Indian firms’ overseas acquisitions in the US and UK often show returns 40 per cent lower than the benchmark BSE index. “Despite their enthusiasm for cross-border M&A deals, Indian players generally have not created shareholder value one year after the deal…” says the report.

Did they get carried away? Venture Intelligence, an outfit that tracks Indian M&A activity, estimates that there were more than 600 overseas deals struck by Indian companies between January 2006 and December 2008. The financial details for less than half of them were disclosed, and yet they added up to deals worth nearly $33 billion, or roughly thrice the annual turnover of FMCG major Hindustan Unilever. The Tata Group alone made overseas investments to the tune of $15 billion over the last boom. And then there were companies such as Hindalco, United Spirits (USL), Suzlon Energy, Essar Steel, Mahindra & Mahindra and even the state-run ONGC.

They were frontrunners in the overseas M&A game. As dollar inflows swelled, thanks to gushing inward investment, the outflows swelled too.

Almost every deal was accompanied by heavy chest-thumping by the Indian media, almost as if the country and its entrepreneurs had a divine right to go conquer the world of business. Therefore, the Tata Group buying Her Majesty’s carmaker and Vijay Mallya’s USL gobbling up a Scottish distillery was not merely a story of the ‘great global Indian takeover’, but revenge on past colonial masters.

But now that the global financial meltdown has hit home, and business values everywhere in the world have slid to levels that could turn anyone pale, India Inc’s add-to-cart addiction looks like turning into a case of rehab. In hindsight, if these Indian companies had waited just a year for their grand splurge, they could have bagged their targets for small fractions, even a fourth, of what they actually paid during the boom. This, even with a much weaker rupee. The buyout funding, of course, would have had to be entirely domestic—by the great Indian banks that are so proud of having escaped the worst of the meltdown.

But then, hindsight is always 20:20, and such criticism is not quite cricket. “You couldn’t have questioned many of the deals when they were struck 12-18 months back,” says Gaurav Khungar, executive director, corporate finance, KPMG, “For almost every major deal, there were several strong competing bids from across the world. Let’s not forget the bidding battle between Tata Steel and Brazil’s CSN for Corus. Although you could argue that a bear market is the best time to expand, companies do not find capital easily, and their ability to use their market capitalisation to raise cash is also affected because the value of their stocks too would have depreciated substantially.” That being the case, would Indian banks really have had the gumption? Or, on Mark Twain’s forecast, would they have withdrawn the umbrella just as it began to rain?

SALVAGE OPERATION

If Ratan Tata has consolation, it is the somewhat happier outcome of the Tata Steel-Corus marriage. Tata Steel’s acquisition of Corus hit headlines as the biggest ever by an Indian company. Most analysts agree that if it wasn’t for the recession and consequent slump in global steel demand, the combine could have achieved its target of recovering its investment in about five years. But now, it appears it may take about twice the time. That’s rather a long haul. But given the company’s inherent cost advantages, including access to iron ore, and now international market reach, it’s not such an iffy case. Corus’ European operations are churning out moderate profits, while offering Tata Steel easier access to raw material in other parts of the world.

“Acquisitions make sense at any time if they are well rationalised, and the strategic fit clearly identified,” adds Khungar, “Even if the mergers face cyclical downturns, they will start paying back in ten years rather than five. When the Corus deal was done, there was compelling strategic rationale. Tata Steel in one stroke became the fifth-largest steelmaker in the world, climbing 50-odd places in the pecking order.”

Similarly, Tata Chemicals’ $1 billion buyout of US-based General Chemical Industrial Products Inc in 2008 has made it the world’s second largest soda ash manufacturer. That, coupled with Tata Chemicals’ 2006 acquisition of UK-based Brunner Mond, has given it enhanced pricing power. Tata Chemicals now has access to two of the lowest cost natural soda ash reserves in Wyoming, US, and Magadi, Kenya.

In many ways, it was Hindalco’s 2007 buyout of Novelis, a Canadian aluminium rolling and canning company, that took more observers’ collective breath away. Especially those worried that electricity, a major input cost, is much too expensive in India for an operation that can turn out this metal cheaply. But Hindalco, an AV Birla Group company, wouldn’t have paid $6 billion without a plan. So then, has it worked? On paper, it looked like a nice ‘forward integration’ move, from aluminium bars to cans. There was the combined entity’s heft to consider, too. But in the third quarter of the previous fiscal year, Novelis reported a net loss of $1.8 billion, including $472 million of unrealised losses on derivatives, used to hedge exposure to assorted risks. “To write off the losses of Novelis, Hindalco has diluted itself with the rights issue to the extent that its market capitalisation is now lower than the amount it paid,” says Sanjeev Krishan, executive director, PricewaterhouseCoopers.

As for the state-run ONGC, while its 2008 purchase of British firm Imperial Energy for $2.6 billion—its biggest ever overseas acquisition—has given it access to 920 million barrels of proven and probable reserves of oil in Siberia, the current low prices of crude oil have made the deal look expensive. “This is a matter of energy security and long term planning,” says Krishan.

FLIGHTS OF FANCY

Metals, automobiles and oil, of course, are sectors that are especially dependent on global cycles of demand and supply, going down and up with the world economy. So buyouts in these sectors are best assessed on their ability to survive the current recession. What about the rest?

Liquor, surely, doesn’t obey the same rules. So what of USL’s 2007 acquisition of Whyte & Mackay? As a rare instance of an Indian consumer goods buyout, it attracted attention. Vijay Mallya, chairman of USL, shelled out $1.1 billion for the Scotch company, again at a time when business valuations were peaking. But with Mallya’s UB Group airline, Kingfisher, burning up cash in the recession-hit aviation market, the group is in a cash crunch. Just months ago, USL wanted to raise some money by divesting a 49 per cent stake in Whyte & Mackay. With no takers, say sources, the Bangalore Branson is now on the lookout for a buyer to barrel out the entire company. British analysts say he may have to sell the distiller at a 50 per cent discount, what with bulk Scotch prices dropping by nearly 20 per cent.

Says the research head at a large brokerage house, “Many acquisitions fail to deliver the required value because the decision is either based on reasons of ego or to provide short-term impetus to the stock on the bourses. Decisions based on ego are likely the fail the most. Almost all of Mallya’s business decisions seem to stem from ego, be it buying a distiller, an F1 team, a cricket team or starting an airline.” To fly another day, Mallya would have to convert all the brand equity he has spent such energy on into cash, and that’s not easy in a downturn.

Easy money tends to fuel bravado, but tighter conditions are the real test of mettle. Look away from the glamorous billion dollar deals for a moment, and you will see signs of it in unexpected places. Take the case of United Phosphorus (UPL), for example. India’s biggest pesticide company, it has astutely used an M&A strategy to go global. How? With a horses-for-courses strategy, the kind used by the IPL 2008 winners Rajasthan Royals. Since 1994, UPL has inked 26 international M&A deals, with its details-driven boss Rajju Shroff buying not just headline-hogging international firms, but assorted assets in the form of generic formulations, subsidiaries, business units and standalone factories that bigger players wanted to hive off. All these assets serve some strategic purpose or the other. Today, USL is a global enterprise with interests across five continents.

And now, as we wonder whether India’s biggest business houses will be able come good on their ambitious M&A gameplans, it’s worth reviving the original question that started the frenzy back in 2006: is there a good way to overcome the boom-and-bust cycle?

/wp-content/uploads/2025/07/Cover_Dalai-Lama.jpg)

More Columns

India’s First Vision-Only Autonomous Car Was Built for Chaos Open

Trump Restarts Tariff War With the World Open

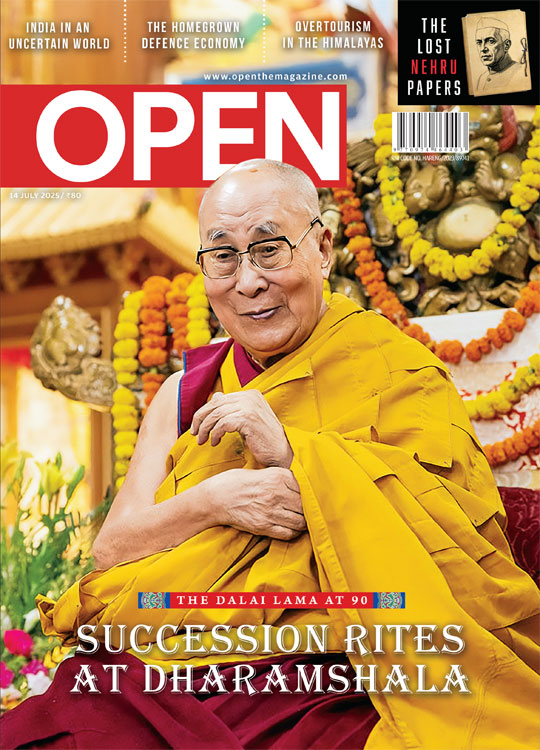

‘Why Do You Want The Headache of Two Dalai Lamas’ Lhendup G Bhutia