The Curious Case of Children Bank of India

Play notes at play

Omkar Khandekar

Omkar Khandekar

Omkar Khandekar

Omkar Khandekar

|

01 Nov, 2017

|

01 Nov, 2017

/wp-content/uploads/2017/11/Playnote1.jpg)

THE MAN WITH the walrus moustache looks sad. His name is Rehan Khan, he tells us. He is a hanky-seller turned real estate litigator turned politician. He’s walked the path of truth his entire life. Now he is being accused of running a counterfeit currency racket in Mumbai. The cops are hunting for him, hounding his family. “Main bahut takleef mein hoon, iss liye main aap ke saamne aaya hoon (I am here because I am distressed),” he wails. He folds his hands. His voice cracks. “Meri begunaahi ka saboot main khud hoon. Please meri madad kariye. (I am the proof of my innocence. Please help me.) Please. Please.” He wipes his tears. He gives a tiny nod.

Cut.

The 15-minute video, posted on Rehan’s Facebook profile on October 15th, didn’t quite get the response he was hoping for. ‘Good work,’ one wrote. ‘Jai Bhim,’ said another. One claimed Rehan had still not returned the Rs 40,000 borrowed a year ago. Another, in multicolour expletives, called him a freeloader and con-artist who spares no one, friend, sister or bar-dancer.

Officials from the Directorate of Revenue Intelligence, the intel-wing of Indian Customs, arrested him the next day. Khan, the DRI said, headed a city-wide racket of counterfeit currency along with three others: Mahesh Alimchandani, a builder from suburban Bandra, Haji Imran Alam Sheikh, a mid-level Congress worker, and his uncle Zahid Shaikh. The counterfeit currency was manufactured in Bangladesh, smuggled into India through Islampur and Malda in West Bengal, and circulated in the country through a network of suppliers, vendors and couriers.

Of the Rs 50 lakh seized from Khan’s gang, notes with the face-value of 18 lakh conformed to the Bangladesh module. The printers had forged nearly 25 of the 31 security features of India’s new Rs 500 and Rs 2,000 currency notes. This included the security thread, coloured ink and embossed image of Mahatma Gandhi. The sophistication of this batch was unexpected. Until now, most of the forged bills had copied only upto 17 security features.

“These were so good,” an officer said, “you wouldn’t be able to tell it from a fake if I gave one to you.”

But the pedigree of the remaining seizure of Rs 32 lakh was truly baffling. These were play notes. Similar to real ones in size and design, only minted at a ‘Children Bank of India’. This, the officer said, was linked with another scam Khan had started over the past 10 months: conning people by offering to buy their demonetised bills. His victims included politicians, jewellers and businessmen; anyone who hadn’t been able to whitewash their stash after the government phased out Rs 500 and Rs 1,000 bills last November. Khan would set up meetings at his apartment and exchange their worthless currency notes with his bundles of Rs 2,000 bills, wrapped in plastic. His employees would then stage a police raid, forcing the clients to flee. They would later discover they had received play notes in the barter. But then, they couldn’t quite lodge a complaint of their black money being stolen. And Khan would coolly sell the demonetised cash at 11 per cent of its original value to an associate in Pune, a man who did deal in demonetised notes.

“In all my years,” the officer said, “this is the first time I came across a counterfeit racket with toy currency.” The DRI traced its source to Abdul Rehman Street near a popular shopping complex of Crawford Market in Mumbai. But could they really arrest someone for manufacturing or selling a plaything? After all, each of these seized bills had a disclaimer right there in place of the governor’s signature: ‘Use for show’.

IN HIS TELEVISED Speech on November 7th, 2016, Prime Minister Narendra Modi deemed demonetisation necessary to “break the grip” of corruption and black money. Strictures were issued against Rs 500 and Rs 1,000 bills, which accounted for 86 per cent of total currency in circulation then. For years, said the Prime Minister, enemies across the border were printing fake versions to fund terrorism in India. Corrupt officials were storing them in gunny bags, hiding them under beds. Not to forget the role these big denominations played in hawala networks, illicit poll campaign funding and the illegal weapons trade.

The pedigree of the seized counterfeit notes worth Rs 32 lakh was baffling. These were play notes. Similar to real ones in size and design, only minted by a strange unheard-of bank

“With just one stroke on 8th November,” Modi declared in an election rally in Uttarakhand the next month, “the worlds of terrorism, drug mafia, human trafficking and fake note smuggling were destroyed.”

But by early 2017, the counterfeiters seemed to be back. First the amateurs, with their scanned copies from inkjet printers; later, the sophisticates with imported currency paper rolls. Intelligence reports leaked to the press spoke of the Pakistan’s Inter Service Intelligence agency reactivating its networks in Bangladesh and Nepal to pump fresh batches of fake currency notes into India. This time, they had reportedly roped in gangster Dawood Ibrahim for his contacts within the country. In January, Border Security Force personnel seized fake Rs 2,000 bills with the face value total of Rs 1 lakh. By August, it was Rs 5.2 lakh in a single operation.

“All demonetisation did was to take the existing currency out of circulation,” says Dr Ajai Sahni, executive director of Indian Conflict Management, a think-tank that tracks terrorist activity linked to fake currency. “In the fight against counterfeits, it was only a one time measure.”

As updates on corruption, black money and counterfeits ruled the daily news cycles, people even started looking at genuine Rs 500 and Rs 2,000 notes with suspicion. A Delhi resident reported that the printed motifs of national emblem and Mahatma Gandhi on a Rs 2,000 note had shadows. Another complained of receiving two Rs 500 notes with unequal borders. Then came WhatsApp trolls. The new notes have a hidden GPS chip visible only when put in a freezer, one popular ‘forward’ said. The ink used in the bills contains radioactive isotopes of phosphorus, read another. The panic was palpable, even if not widespread.

Amidst the chaos, on February 6th, a call-centre executive from New Delhi withdrew four notes of Rs 2,000 from a State Bank of India ATM in Sangam Vihar, New Delhi. They looked similar in font, design and colour scheme, but something wasn’t quite right. He looked closer. The guarantor called itself ‘Children Bank of India’ (or, as the Hindi script added helpfully, ‘Manoranjan Bank’). The RBI’s seal was substituted with the words ‘PK’. Its promissory clause was replaced with a typo-riddled ‘I promise to pay the barer two thousand coupens’.

The demand for play notes surged after the introduction of the new Mahatma Gandhi currency series last October. Fake currency was even purchased by schools for lessons in financial prudence

At Sangam Vihar police station, nobody believed him. Finally, sub-inspector Saurabh Kumar said he’d test it out himself. He entered the ATM, inserted his card and requested a withdrawal of Rs 2,000. He also got ‘coupens’.

The Children Bank resurfaced at least three more times over the next three months. In March, a private bank ATM in New Delhi coughed out a similarly mischievous Rs 2,000 bill. The same month, a security guard in Hoshangabad went to an SBI ATM and received a Rs 500 note with ‘Full of Fun’ printed in place of a watermark. In May, another play note, this time of Rs 2,000, was dispensed by an SBI ATM in Bhind.

SBI didn’t respond to Open’s requests for an interview. But at the time, it had sought to absolve itself of direct responsibility. ‘These machines are equipped with templates of all legal tender,’ it said in a statement released soon after the first incident in Delhi. ‘Any note not conforming to the security features is separated as ‘suspect’ for further manual scrutiny. Thus, no fake note is likely to be dispensed through SBI ATMs.’ Even as the farce re-played itself in Bhind and Hoshangabad, the bank reiterated its claims of having robust technology in place to monitor the authenticity of currency.

There are tempting reasons to believe them. An RBI directive in 2012 had mandated the installation of counterfeit currency identification machines at banks and ATMs. But Som Gangopadhyay, deputy managing director, sales & marketing, at Gunnebo India Pvt. Ltd., estimates that less than half of all banks across India have installed such machines. There are two kinds of ATMs, he explains. A ‘Dispenser’ is equipped only for withdrawals and a ‘Recycler’ also allows cash deposits. “Unlike Dispensers, every Recycler has a built-in identification machine, but 95 per cent of ATMs in India are Dispensers.” It is thus plausible that fakes were introduced at the time of cash reloading.

Sub-inspector Saurabh Kumar had suspected this all along, but the evidence was hard to come by. The SBI ATM he was investigating, like many banks’, was managed through a private contractor, Brink’s India Pvt Ltd. The firm was responsible for its upkeep, refills and security. But this one lacked CCTV surveillance. The ATM front camera too was dysfunctional. Finally, Kumar rounded up the two employees in charge of refilling the machine. One Mohammed Isha cracked. He had had the idea after noticing the play currency of a board game he had gifted his nephew, he confessed. So he bought another and replaced five Rs 2,000 bills with the fakes.

The ATM giving out the fake notes had no CCTV camera. Even the front camera was not working properly. Sab Ram bharose chal raha thha” -Saurabh Kumar, sub-inspector, Sangam Vihar, Delhi

The call centre employee was reimbursed for his losses. Kumar is still waiting for his. “Apply karna thha par waqt hi nahi miltaa (I mean to apply for compensation but barely get the time for it),” he says. “Sarkaari kaam hi aisa hai.”

A NINETIES KID familiar with Indian board games would instantly recognise the cheeky ‘Children Bank of India’ bills from Business, a rip-off of Monopoly. You travel the country, buy cities, build hotels and charge visitors exorbitant rents to stay in them. (One who goes bankrupt loses. For ages five and above.) A life-like game needs life-like currency. Ergo, many versions of Business come with imitations of the legal tender.

“It is an established pattern,” says Jayantilal Visharia, whose Prem Ratna Games has been replicating the Children Bank bills for over a decade. Such play notes are smaller in size, inferior in quality and littered with errors. Some have one-sided prints, others replace the RBI Governor’s signature with ‘Santa Claus’. With the rise of digital gaming, says Gaurav Jain, owner of the Mumbai-based Ajanta Games, only 25-30 manufacturers are now left in Business. Like Jain, most have already switched from paper currency to plastic.

But Children Bank of India isn’t shutting down just yet. The mischievous notes have found quite a few takers even without an accompanying board game.

A week after Rehan Khan’s arrest, I visited Mumbai’s Abdul Rehman Street to trace his play notes to their source. The bustling lane boasts of one of the biggest wholesale markets in the city, selling toys, clothes, antiques, pets, stationary, hardware and an assortment of ‘gift items’, legal and smuggled. Nearly a hundred metres in leads to the Bhajipala lane, featuring some half-dozen knick-knack shops. Ask around and they point you to wads of play notes stocked on display shelves, wrapped in bundles of 100, priced between Rs 25-30.

These are “fast moving items”, a vendor says. Demand had surged after the introduction of the new Mahatma Gandhi currency series last October. Soon, the markets were flooded with wallets, pencil boxes and mobile phone covers designed after a Rs 2,000 note. Fake currency was purchased by schools to familiarise students with the talk of the town and for lessons in financial prudence. Others wanted it for movie-shoots, wedding garlands and money-showers at dance bars.

While the vendors insist that the notes are mostly meant for a laugh, there have been times they have spelt trouble for their sellers. AH Slatewala recalls a shopper trying to pass off a fake at a vegetable market a few months ago. “The police came and interrogated me. I couldn’t sleep for two days after,” he says. For a while, the vendors stopped their sales. But a few weeks later, they brought in a fresh batch of fakes. This time, with their discrepancies even more obvious. One had substituted Gandhi’s image for Chhota Bheem’s, another had reworked the pledge to ‘I promise to pay bearer this my heart and soule’.

But that should hardly be a cause of concern, says a senior banker. Counterfeit notes represent only the most minuscule proportion of currency in circulation, “less than 0.0001 per cent”. Play notes make for an even more insignificant number. While the law is unclear on the manufacture and sales of the latter, there is scope for legal action if there is a culpable attempt at deception. A couple of decades ago, the banker recounts, there was a similar craze of having clocks and watches with currency platings. The police invoked The Emblems and Names Act, which forbade the use of such symbols in a ‘derogatory manner’. “The law is right there,” the banker says. “You only have to define the crime.”

About The Author

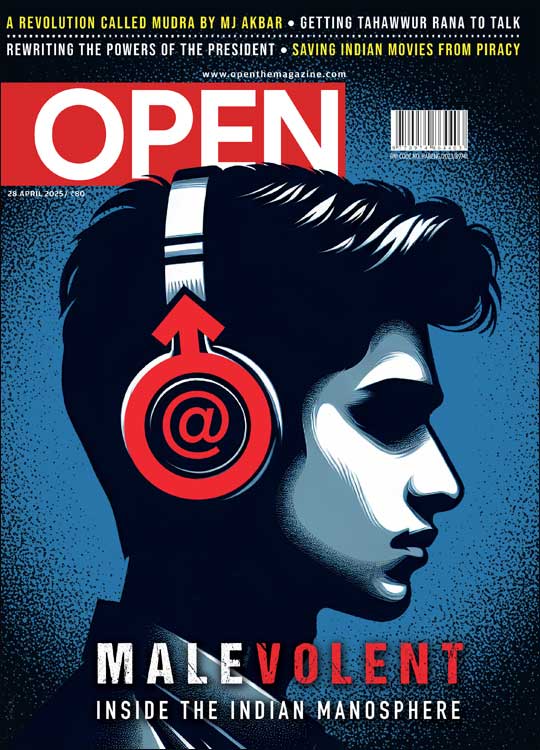

CURRENT ISSUE

MOst Popular

3

/wp-content/uploads/2025/04/Cover-Manosphere.jpg)

More Columns

‘Colonialism Is a Kind of Theft,’ says Abdulrazak Gurnah Nandini Nair

Bill Aitken (1934 – 2025): Man of the Mountains Nandini Nair

The Pink Office Saumyaa Vohra