Open Avenues | Open Avenues: Advertorial

Saving For Retirement

For ample savings for a retired life likely to span more than two decades, start investing early in your work life

Open

21 Nov, 2019

Open

21 Nov, 2019

Here’s some mixed news for you. Thanks to healthier lifestyles, access to better healthcare facilities and increasing incomes, Indians are living longer and longer. According to the data from the World Bank, life expectancy in India increased from 69 years in 2017 from 63 years in 2001. Some estimates project that this will go up to 74 years and more, by 2030. According to many studies, many people in urban India are already living till age 80.

Now, the bad news. Increasing life expectancy is making retired lives longer and longer. Thus, for a retired life that is likely to be more than two decades-long, you only have three decades of work life available to accumulate ample savings. In fact, things could turn out to be even more challenging. Like a football goalkeeper protecting a goal whose goalposts are constantly shifting apart, increasing life expectancy is increasing the risk of you outliving your money. Thus, it is becoming more and more important for you to have substantial savings for your retirement. Then, there are some other trends increasing the degree of retirement savings challenge.Workplace uncertainty, economic changes, including international developments along with technological advances and innovation are threatening job security. One can no longer be sure of long periods of stable employment required for regular and concerted efforts towards retirement savings.

Absence of social security

Unlike many developed countries in the West, India doesn’t have a government old-age pension and health insurance. This means, that the only source of retirement income and meeting old age medical emergencies is your own retirement savings.

Inadequate provident fund savings Many people who are employed in the organised sector think of Provident Fund (PF) as the saving source for meeting retirement needs. Since only a fixed amount can be put away for Provident Fund deduction (linked to your basic pay) with limitations in the growth possibilities, it is becoming abundantly clear that people need savings that substantially supplement PF money.

Declining family support

Migration to urban India and to countries abroad to tap economic opportunities, along with declining family sizes, is making it unlikely for people to be able to bank on family support in case of a shortfall in retirement savings.

In the backdrop of mounting challenge for accumulating ample retirement savings, what should be the course of action? The answer lies in starting regular retirement savings effort at the earliest. An early start, typically at the beginning of work life, will ensure that you get the most out of the compounded growth of your money. This means that through regular contributions over time, thanks to an ever-growing principal, your retirement savings keeps growing to staggering levels.

Securing retirement with an early start

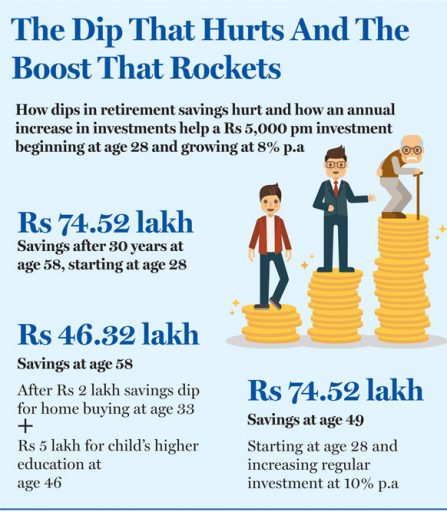

If you invest Rs 5,000 every month and the money grows at 8% annually from age 28, you save Rs 74.52 lakh after 30 years. Start five years later, at age 33, you save Rs 47.55 lakh i.e. Rs 26.97 lakh, or 36.19% less for a 5 year delay. However, the bigger damage happens when, like most Indians, you make partial withdrawals from your retirement savings.

Damage from partial withdrawals Let’s assume that in the same example, you invest Rs 5,000 every month and the money grows at 8% annually from age 28, you withdraw Rs 2 lakh at age 33 after five years for down payment of home and Rs 5 lakh for child’s higher education at age 46, at retirement at 58 years, you only have Rs 46.32 lakh i.e. Rs 28.2 lakh or 37.84% less. This is even worse than starting five years later.

Boost from increasing regular investments

When you start retirement savings early in your work life, you have lots of opportunities for saving much more than you can imagine. One way of doing this is to increase the regular investment amount every year when you get a pay hike. This can happen through Top-Up Systematic Investment Plans (SIPs) in mutual funds and the Top-Up facility in unit-linked insurance plans (ULIPs) from life insurance companies. In our example, if we increase the regular investment amount by 10% every year, after starting at age 28, we reach the figure of Rs 74.52 lakh in 21st year itself. This means another nine long years to add to the retirement savings kitty.

Clearly, to win the retirement savings game, the key is to start saving early and ensure there are no disruptions. In many ways, it is like running a marathon. You need to start running the right way and keep at it till you breast the tape at the finish line.

(A marketing initiative by Open Avenues)

More Columns

I Missed A Flight Thanks To Robert Redford, Plus He Took My Magazine! Alan Moore

Robert Redford (1936-2025): Hollywood's Golden Boy Kaveree Bamzai

Surya and Co. keep Pakistan at arm’s length in Dubai Rajeev Deshpande