New Cheque Norms

The RBI is doing its best to curtail fraudulent transactions and ensure faster clearing services for digital cheques.

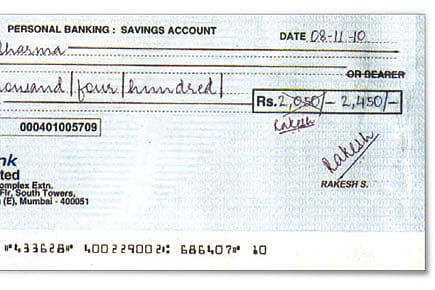

The RBI is doing its best to curtail fraudulent transactions and ensure faster clearing services for digital cheques. Kicking in on 1 December are the central bank’s guidelines on the image-based Cheque Truncation System that stipulate benchmark security features for all commercial banks to follow. Now altered, corrected, over-written or changed cheques will no longer be accepted by image-based processing systems at clearing houses.

“What the rules miss out is on how to tackle rural cheque transactions, where more people make mistakes when writing cheque forms. In the face of these new norms, what happens to cheques that people already have?” says Rakesh Agarwal, a New Delhi chartered accountant. The positives, he says, are that it would bring financial security to both banks and customers. And a little discipline for people filling out cheques.