Fuzzy Central Banking

India has kept a fuzzy balance of all three goals that make up the ‘impossible trinity’

The Reserve Bank of India (RBI) has done the expected and tightened the lending of money, raising both its Laf rates—the repo and reverse repo. Industry is not complaining. “CII understands the RBI’s concern on inflation and hardening inflationary expectations,” in the words of Chandrajit Banerjee, director general of this industry confederation, “We are reassured by RBI’s statement that it is unlikely to increase rates again in the near future.” Analysts interpret the move as an indication of the central bank’s priority right now. “The 25 basis points hike reflects the predominance of inflationary concerns over the concerns of moderation in domestic growth, notably in industrial activity,” says Jay Shankar, chief economist & executive vice-president, Religare Capital Markets Ltd.

Clearly, containing inflation is Goal No 1. But, as global trend watchers point out, higher domestic rates could attract even larger funds from overseas (in search of higher returns), especially if the US turns its loose money policy looser still, as widely expected, pushing the rupee upwards. And if inflation is a policy worry, so is guarding the rupee’s exchange rate from sudden distortions caused by ‘lumpy and volatile’ dollar inflows. The rupee is roughly where it should be, in its no-chaos zone, at the moment. But that could change in a flash.

For the RBI, there is no escape from the so-called ‘impossible trinity’: one cannot have three things—a monetary policy independent of global forces, a currency pegged to a foreign one, and an economy open to capital inflows and outflows—simultaneously. Most market economies let their currencies float freely. India, ever since it opened up partially to foreign capital, has kept an astute balance of fuzzy measures on all three, shifting a bit on one, moving a little on the other.

Imran Khan: Pakistan’s Prisoner

27 Feb 2026 - Vol 04 | Issue 60

The descent and despair of Imran Khan

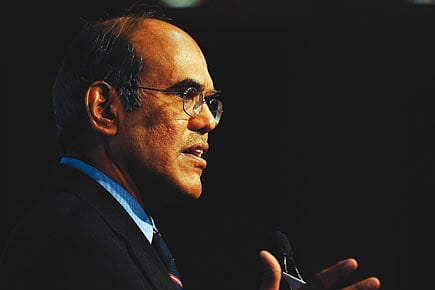

Guessing the RBI’s inclinations is something of a parlour game. When Governor Subbarao assumed office just as the Great Recession struck, he seemed to favour the market ideal of a fully flexible currency, and the rupee did a yo-yo act. But India’s current economic scenario and his recent hints suggest a policy nudge towards gaining greater control of both inflation and the rupee. That might make new clamps on capital flows inevitable. But, as the world ought to know, it’s all for a good cause: overall stability. Fuzziness has its virtues.